Online Reading Club | The Construction and Rise and Fall of the Millennium Capital: Kyoto under the Historical Flood

How to write a frightening and thought-provoking mystery novel?

Time:July 30th (Friday) 20:00-21:00

Location:Litchi podcast

Guest:Zhuang Qin (thriller mystery novel writer) and Inspector Tie (manager of Sanhuqiao Detective Agency)

Litchi Podcast Suspense Live Week series activities, this field invited mystery novel writer Zhuang Qin to talk with Inspector Tie, the manager of Sanhuqiao Detective Agency. The biggest goal of Zhuang Qin’s writing is to write a frightening and thought-provoking mystery novel, and strive to combine Hitchcock’s suspense with Poe’s horror. So how can we do it?

What kind of mystery novel has the potential of film and television?

Time:July 30th (Friday) 21:00-22:30.

Location:Litchi podcast

Guest:Kwai Taguchi (mystery writer), Afra (manager of whispering), An Zhiyong (screenwriter), Cao Yun (producer and script planner)

Many mystery novel films have been remake into TV dramas, with good box office and good reputation. So what kind of mystery novel has the potential of film and television? Litchi Podcast Suspense Live Week series activities, this field invites mystery writers and screenwriters and producers in the film and television circle to talk about the topic of film and television.

Deciphering the era of pressure: how to scientifically "stress mountain"

Time:July 31st (Saturday) 10:00-11:00.

Location:Sina Weibo @ Shanghai Library Messenger

Speaker:Li Shijia (Associate Professor, School of Psychology and Cognitive Science, East China Normal University)

Stress is the "spice of life" and the sharpening stone of a strong self. Stress and coping experience shape lifestyle and mind, just like getting sick after being infected with bacteria or viruses, and gaining immunity after recovery. Taking stress as a mirror, we can know ourselves better and love ourselves more. How do we deal with emotions and coexist with stress? On Saturday morning, Sina Weibo @ Shanghai Library Messenger watched the online sharing meeting.

Citing the past, evaluating the degree, and the order of etiquette: poetry and gentleman’s interpretation in Zuo Zhuan

Time:July 31st (Saturday) at 18:30.

Location:Tencent conference (ID: 81585448056)

Speaker:Ke Martin (Chair Professor, Princeton University)

Among the many unusual features of Zuo Zhuan (compared with any other historical writing in all ancient civilizations around the world), two are interrelated: first, the quotation and performance of traditional texts, especially the poem; Secondly, a kind of comment and historical appreciation (that is, one of several evaluation methods) on a specific level caused by "gentleman saying". A gentleman is not any specific figure, but an anthropomorphic representative of Confucianism in the Warring States period. His comments on historical narrative are independent of the narrative and wander in it, thus blurring and diluting the boundary between "text" and "comment". Secondly, what the gentleman said is closely related to quoting the ancient times, especially the poem, and is always presented in a moral preaching mode. The purpose of this lecture is to analyze the phenomenon that quoting Poems is closely related to "Gentleman’s Saying", and put forward that they actually serve two important purposes: first, to put the original materials of Zuo Zhuan under the ideological framework of Confucianism in the Warring States Period; Secondly, it teaches readers of Zuo Zhuan how to evaluate history morally and how to immerse themselves in traditional classics and idealized cultural practices. To sum up, Zuo Zhuan not only has expressiveness and performance, but also teaches readers how to become a gentleman and how to master the biography of Poetry.

From books and documents to information flow: on the development of literary research in sinology in North America

Time:August 3rd (Tuesday) 15:30-17:00.

Location:ZOOM conference

Speaker:Xu Mingde (postdoctoral fellow, Institute of Oriental Studies, Oxford University)

Under the influence of the history of books and the history of new culture, the history of reading has made great progress in the past 30 years, which not only makes us pay more attention to the way of text generation and the editor’s mentality of proofreading, but also makes us rethink many stereotypes and conventions in the original literary history. In recent years, the history of reading is more based on information science, trying to understand the streaming of literary texts from the aspects of information collection, classification, processing, dissemination, storage and retrieval. In this speech, I hope to illustrate the development and trend of this kind of research by using three specific cases: (1) writing manuscripts in the Middle Ages, (2) Song Ci, and (3) the study of bookshops in the Ming and Qing Dynasties.

Darkness, Thriller, Profound and Interesting —— The Unique Soul World of Female mystery novel Writers

Time:August 3rd (Tuesday) 19:00-20:00.

Location:Litchi podcast

Guest:Ye Congling (mystery novel writer), Shui Mei Yiren (mystery novel writer), Qi Diao Xing (mystery novel writer) and Xiao Yao UU (mystery novel writer).

What are the characteristics of female mystery novel writers’ works? Litchi Podcast Suspense Live Week series, in which four women are invited to share their writing.

The "Controversy" between the Classics and Social Schools in the Reasoning Circle

Time:August 4th (Wednesday) 19:00-20:00.

Location:Litchi podcast

Guest:Beaver (science fiction writer, children’s literature writer), Shichen (mystery writer), Hu Yanyun (mystery writer), Wasby (mystery researcher)

In the last activity of Litchi Podcast Suspense Live Week, four distinguished guests were invited to talk about a topic that has been debated for a long time in the reasoning circle: Is it a stereotype or a social school?

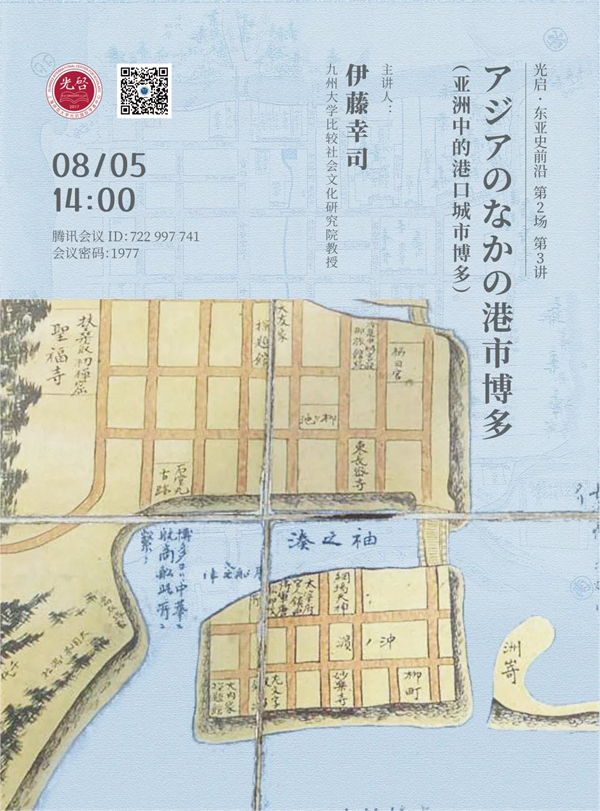

Hakata, a port city in Asia

Time:August 5 (Thursday) at 14:00

Location:Tencent conference (ID: 72297741, password: 1977)

Speaker:Koji Ito (Professor, Institute of Comparative Social Culture, Kyushu University)

Koji Ito is mainly engaged in the research on the history of Japan’s medieval foreign relations, the history of East Asian seas, the history of diplomatic documents and the history of Zen temples. His main works include Hakata and Asia in the Middle Ages (2021). In this lecture on the frontier of East Asian history, we invite Professor Yukio Ito to give a lecture on Hakata, a port city in Asia.

Attachment: Preview of offline activities

Beijing | Scotland and Scottish Nation at the Crossroads

Time:July 31st (Saturday) 15:00-17:00.

Location:SKP RENDEZ-VOUS, Floor 4, Beijing SKP Shopping Center, No.87 Jianguo Road, Chaoyang District

Guest:Meng Huaxuan (representative of the Scottish government in China), Xu Heqian (director of the international news department of Caixin Media), Xu Yitong (translator) and Gao Lin (writer and book reviewer).

The Scottish Nation: A Modern History is one of the "Scottish Trilogy" written by British scholar T.M. Devine. It describes in detail the history of Scotland from 1700 to 2007 for nearly 300 years, so as to help readers better understand why the alliance between Scotland and England, two independent nations, lasted for 300 years, the current situation of Scotland, and the historical origin of England and even Britain. On the afternoon of July 31st, when the Chinese version of The Scottish Nation was officially launched in Oracle Bone Inscriptions, we were fortunate to invite Martin McDermott, the representative of the Scottish government in China, Xu Yitong, the translator of this book, Xu Heqian, the director of the international news department of Caixin Media, who studied in Scotland, and Gao Lin, a writer who is familiar with European history, to review and analyze the past and present of Scotland, and to discuss the formation of Scotland’s "national image", its accession to the United Kingdom, Scotland and the European continent.

Beijing | Materialized Poetic Imagination —— A Seminar on Mark Tuzhou’s Poems of the "90s Generation"

Time:July 31st (Saturday) 15:00-18:00.

Location:Coder Bookstore, Floor 1, Building 15, Far East Instrument Company, No.6 Hepingli North Street, Dongcheng District

Guest:Mark Tuzhou (poet), Liu Nianjiu (poet, poetry critic), etc.

In fact, the incarnation of reason represents an important turn of modern philosophy, which has made considerable progress in maurice merleau-ponty’s phenomenology of body, and also spread throughout radical philosophy such as Alain Badiou’s claim to Pessoa. Bartius asked what kind of philosophy could be worthy of Pessoa’s poems, and we had to ask reversely, did our current poems keep up with the call of philosophy of the times, or could lead a more novel philosophy?

Beijing | Story of Cruel Youth —— A screening of "Rest on a Horse"

Time:July 31st (Saturday) 19:00-21:00.

Location:4-1 One-way Space, North Zone, Dongfeng Art District, No.6 Nanlijia, Jiuxianqiao Tuofangying, Chaoyang District

The Young Man of Grambe is a collection of stories consisting of six short stories and a novella, and the film "Rest on a Horse" is adapted from one of the novellas. On July 31, One-way Space will hold an offline free movie viewing activity of "Rely on the Horse".

Shanghai | Reread the classic The Catcher in the Rye: Are you lonely in the crowd, too?

Time:July 30th (Friday) 19:00-21:00

Location:Sinan Bookstore, No.517 Fuxing Middle Road, Huangpu District

Guest:Wang Zhan Hei (writer) and Zheng Shiliang (executive editor of The Paper Shanghai Book Review)

Seventy years ago, on July 16th, American writer J.D. Salinger’s novel The Catcher in the Rye came out, which influenced the youth of generations. On the evening of July 30th, guests Wang Zhan Hei and Zheng Shiliang will come to Sinan Bookstore to take you into the inner world of the protagonist Holden again.

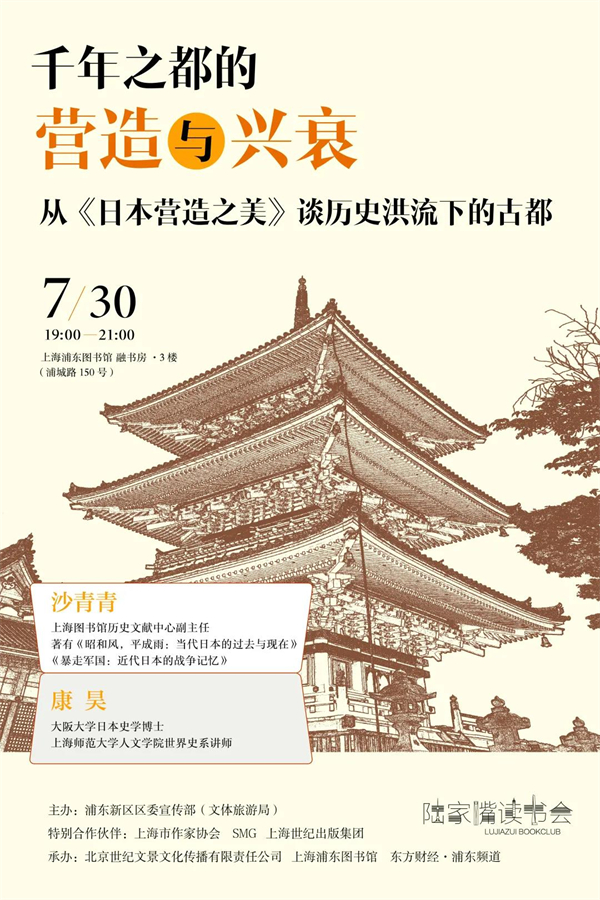

The Construction and Rise and Fall of Shanghai | the Millennium Capital: Talking about the Ancient Capital under the Historical Torrent from The Beauty Made in Japan

Time:July 30th (Friday) 19:00-21:00

Location:3/F, No.150 Pucheng Road, Pudong New Area, Shanghai Pudong Library Rong Study Room

Guest:Sha Qingqing (Deputy Director of Shanghai Library Historical Documentation Center) and Kang Hao (Lecturer of World History Department of Shanghai Normal University)

How was Kyoto, whose capital has been established for more than 1,200 years, built? How can the ancient capital, which has experienced numerous disasters and wars, be reborn? How do new political forces create new urban forms? How does the civic culture bred in it change or even dominate the fate of the city? Has Japan’s ancient capital been successfully transformed into a city suitable for the new era? What is the difference between Kyoto under the lens of tourists and Kyoto living in it? On Friday night, Lujiazui Reading Club invited Sha Qingqing and Kang Hao, Japanese historians, to talk with us about how the ancient Japanese capital was built under the historical torrent and how it became what it is today.

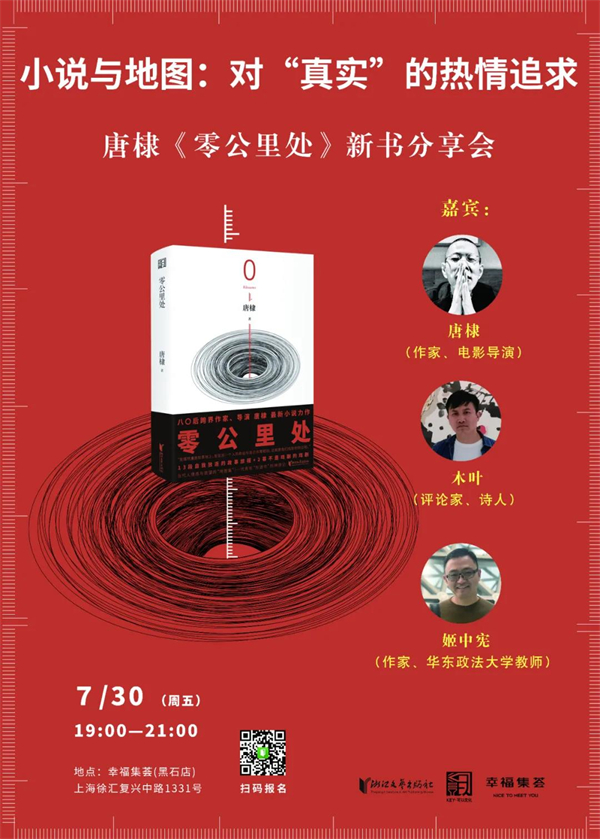

Shanghai | Novels and Maps: Passionate Pursuit of "Truth" —— Tang Di’s New Book Sharing Meeting of Zero Kilometers

Time:July 30th (Friday) 19:00-21:00

Location:Xingfu Jihui, No.1331 Fuxing Middle Road, Xuhui District

Guest:Tang Di (writer and director), Konoha (critic and poet) and Ji Zhongxian (writer and teacher of East China University of Political Science and Law).

Zero Kilometers is the first novel of Tang Di, a post-80s writer and film director, which shows his creative ambition different from writing short stories or screenplays. On the evening of July 30th, Tang Di, critic, poet Konoha, and writer Ji Zhongxian, will be a guest at the Happy Gathering Blackstone Store to talk about the work Zero Kilometers and share with readers a strange journey from Zero Kilometers.

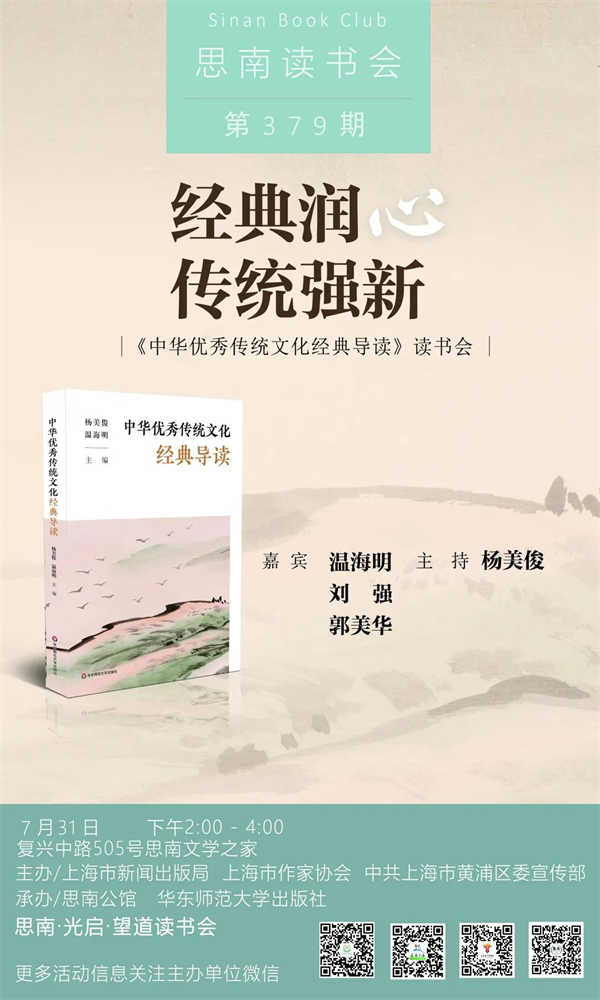

Shanghai | Classic Nourishes the Heart, Traditions Strengthen the New —— Reading Club of Classic Introduction of Chinese Excellent Traditional Culture

Time:July 31st (Saturday) 14:00-16:00.

Location:Sinan Literature House, No.505 Fuxing Middle Road, Huangpu District

Guest:Wen Haiming (Professor, Doctoral Supervisor, School of Philosophy, China Renmin University), Liu Qiang (Professor, School of Humanities, Tongji University) and Guo Meihua (Professor, School of Humanities, Shanghai University of Finance and Economics)

What does traditional culture mean to us today? Internally speaking, it can respond to our inner needs, nourish our hearts, and thus produce life ideals, ethical concepts and aesthetic tastes; Looking to the outside world, we can point to the educational goal of educating people in the new era, and use Chinese excellent traditional cultural classics to achieve the current cultural education and cultural power. "Those who get Chinese get the world, and those who get traditional culture get Chinese". What is the relationship between Chinese excellent traditional culture and the future development of teenagers? How should we view Chinese excellent traditional culture today? On the afternoon of July 31st, in Sinan Literature House, the creative team of "Introduction to Classic of Chinese Excellent Traditional Culture" will guide us into the classic of traditional culture, tell the story behind the classic, and explain why the classic becomes a classic, how the classic becomes a classic, what is the reading value of the classic, what is the reading method of the classic, and how we can learn from the classic.

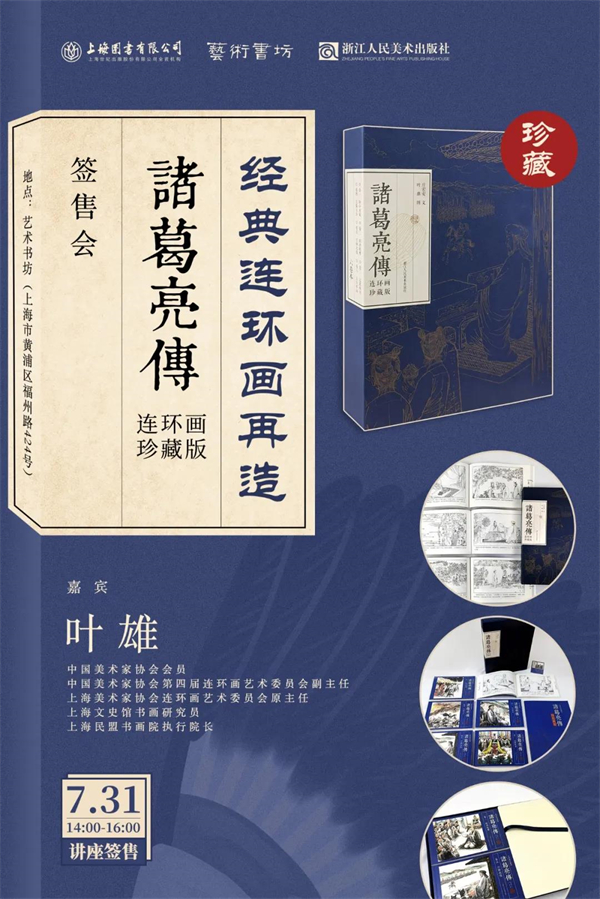

Shanghai | Reconstruction of Classic Comic Books —— Signing Meeting of Zhuge Liang Biography (Comic Book Collection Edition)

Time:July 31st (Saturday) 14:00-16:00.

Location:Art Bookstore, No.424 Fuzhou Road, Huangpu District

Speaker:Ye Xiong (comic book artist, researcher of painting and calligraphy in Shanghai Literature and History Museum)

On July 31st, Ye Xiong, a famous comic book artist, will hold a signing ceremony in the art bookstore with his masterpiece Zhuge Liang Chuan (comic book collector’s edition).

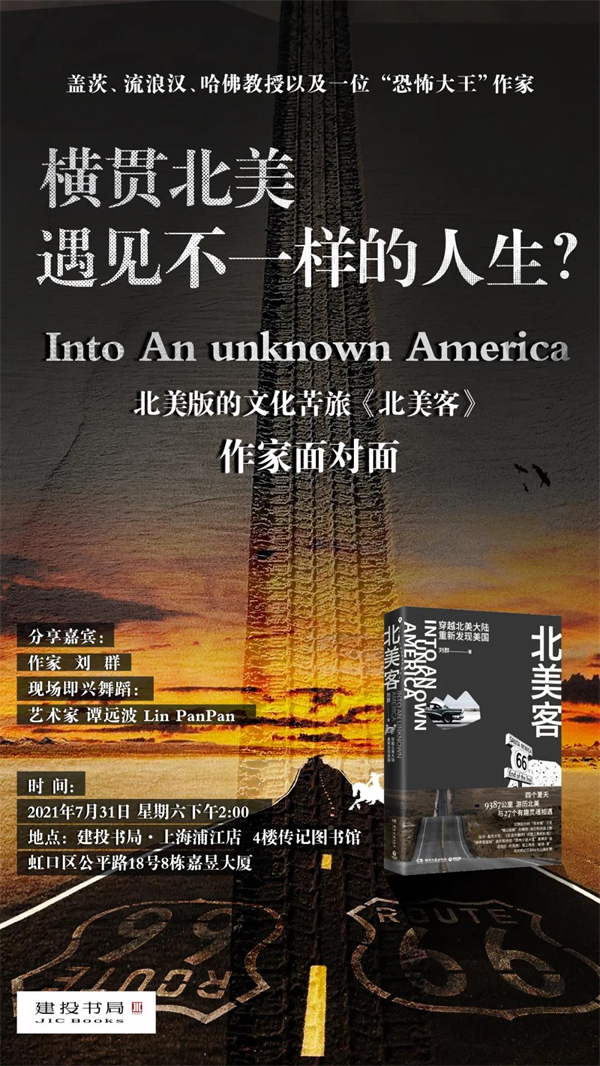

Shanghai | Across North America, Meet a Different Life? -The North American version of the cultural journey "North American Guest" writers face to face

Time:July 31st (Saturday) 14:00-16:00.

Location:The Biography Library on the 4th floor of Investment Press was built on the 1st floor of Jiayu Building, Building 8, No.18 Gongping Road, Hongkou District.

Guest:Liu Qun (writer), Tan Yuanbo (dance artist), Lin Panpan (impromptu body performer) and Wu Liqiang (artist).

On the afternoon of July 31st, Jiantou Bookstore will jointly collect Tianjuan and invite Liu Qun, the author of North American Guest, to share his 4-year, 9387-kilometer North American version of "Cultural Journey". During the activity, he will tell several life stories selectively, and dance artist Tan Yuanbo and impromptu body performer Lin Panpan will bring impromptu dance performances. Let’s meet interesting souls on the spot.

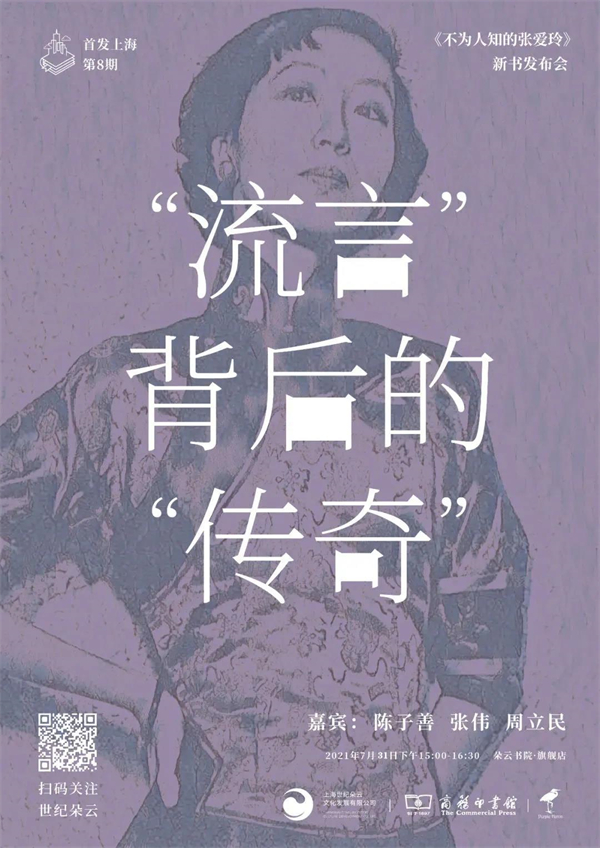

Shanghai | "Legend" Behind "Gossip" —— The release of the new book "Unknown Zhang Ailing"

Time:July 31st (Saturday) 15:00-16:30

Location:Duoyun Academy, 52nd Floor, Shanghai Tower, No.501 Yincheng Middle Road, Pudong New Area

Guest:Chen Zishan (researcher of Chinese Department of East China Normal University), Zhang Wei (research librarian of Shanghai Library) and Zhou Limin (executive deputy curator of Ba Jin’s former residence).

In addition to the Shanghai version of Legend and Gossip, Zhang Ailing also designed the binding of her own works? Zhang Ailing had a chance to leave images and sounds besides The Contrast? The Unknown Eileen Chang is the latest anthology of Chen Zishan’s discussion on Eileen Chang, which makes a new exploration, textual research, collation and interpretation of Eileen Chang’s literary historical materials, and "thinks that there is a new discovery". On the afternoon of July 24th, three distinguished guests, Chen Zishan, Zhang Wei and Zhou Limin, will come to the flagship store of Duoyun Academy to reveal the legend of Zhang.

Shanghai | The Awake Light-Benjamin and His The Sonnets

Time:July 31st (Saturday) 15:00-17:00.

Location:Poorthater area between 104 God Beasts, Phase 4, No.8 Bridge, No.457 Jumen Road, Huangpu District

Guest:Li Shuangzhi (researcher of German Department of Fudan University) and Wang Fanke (director of German Teaching and Research Section of Xiamen University)

The Sonnets is a rare literary work in walter benjamin. These eighty poems were all written in the author’s youth, which is an important witness of the author’s ideological transformation period, and is of great significance to understanding and studying Benjamin and German poetry. On the afternoon of July 31st, with the publication of the Chinese version of The Sonnets, the translator Wang Fanke and the school translator Li Shuangzhi will come between the beasts, and the two scholars will lead you to read and understand Benjamin as a poet.

Shanghai | Interpreting Wang Xifeng from the Modern Feminine Consciousness —— Appreciation and Sharing Meeting of Peking Opera "Wang Xifeng makes a scene in Ningguo Mansion"

Time:August 1st (Sunday) at 13:30.

Location:Duoyun Academy Drama Store, No.398 Changle Road, Huangpu District

Guest:Guo Chenzi (Associate Professor of Shanghai Theatre Academy) and Yang Yang (Peking Opera Actor)

The Peking Opera Wang Xifeng made a scene in Ningguo Mansion, which was adapted from A Dream of Red Mansions, one of Four Great Classical Novels, and has defied the stage for decades. This performance, based on the version of Tong Zhiling’s performance in 1982, focuses on combing Wang Xifeng’s action clues and psychological context, highlighting the human tragedy in the atmosphere of a specific era. On the afternoon of August 1st, Guo Chenzi, an associate professor of Shanghai Theatre Academy, and Yang Yang, a national first-class actor, will come to Duoyun Academy and Drama Shop to deeply interpret Wang Xifeng from the perspective of modern female consciousness.

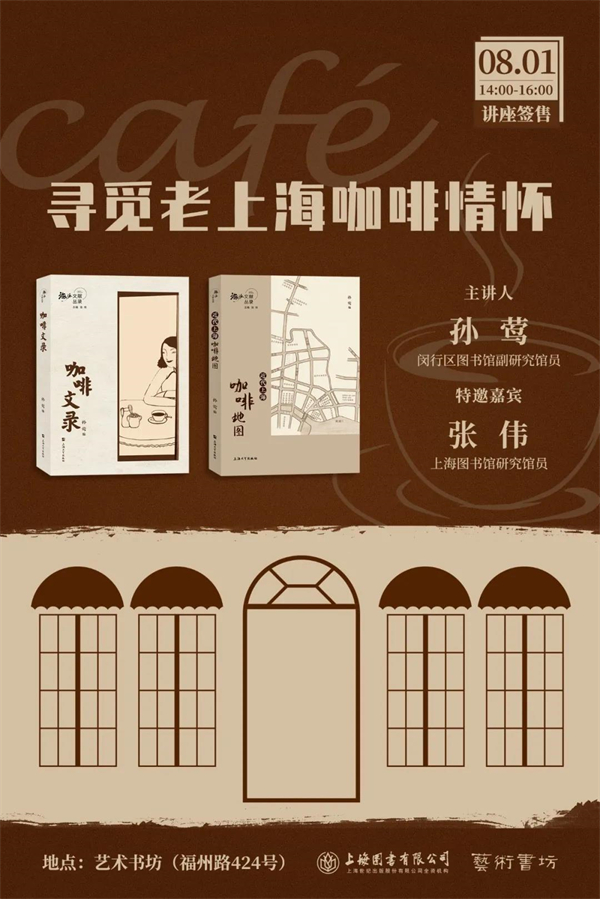

Shanghai | Looking for Old Shanghai Coffee Feelings

Time:August 1st (Sunday) 14:00-16:00

Location:Floor 1, Art Bookstore, No.424 Fuzhou Road, Huangpu District

Guest:Sun Ying (Deputy Research Librarian of Minhang District Library) and Zhang Wei (Research Librarian of Shanghai Library)

In the mid-19th century, coffee, as an exotic product, took root in Shanghai, a land where Chinese and Western cultures merged, and then gradually merged into the texture of the city. Coffee culture has become an important part of Shanghai culture, and coffee has also become a unique business card of Shanghai. On August 1st, we invited Sun Ying, deputy research librarian of Minhang District Library, and Zhang Wei, research librarian of Shanghai Library, to give a lecture on "Looking for Old Shanghai Coffee Feelings" in the Art Bookstore. During the activity, the two guests will lead the readers to start a special "taste journey" around the interesting culture, celebrity complex and historical events related to coffee.

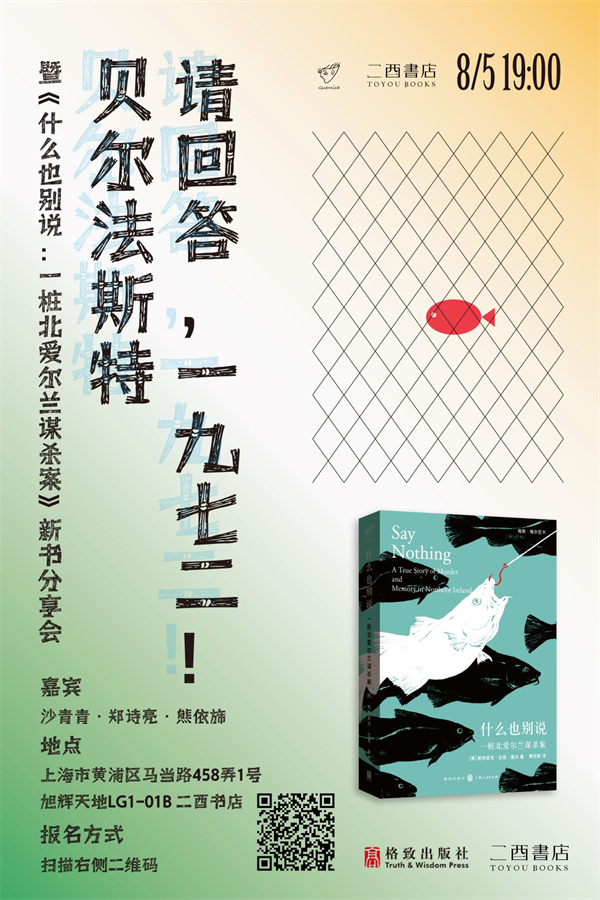

Shanghai | Come in, 1972! Belfast-Sharing Meeting of the New Book "Say Nothing: An Irish Murder"

Time:August 5 (Thursday) at 19:00

Location:Xuhui Tiandi LG1 Eryou Bookstore, No.1 Lane 458, Madang Road, Huangpu District

Guest:Sha Qingqing (deputy director of the Historical Documentation Center of Shanghai Library), Zheng Shiliang (executive editor of The Paper Shanghai Book Review), Xiong Yi-fang (translator).

One day at the end of 1972, Joan McConville, the mother of ten children, was kidnapped from her home in Belfast by a group of masked men, and her children never saw her again. This is the most notorious case in the Northern Ireland conflict. Who killed Joan McConville? At the launch of this new book, we invited three guests, Sha Qingqing, Zheng Shiliang and Xiong Yicheng, to introduce the contents of Don’t Say anything to readers and try to answer the question "What should Northern Ireland answer".

Hangzhou | Boundless Reality, Endless Journey —— Sharing Meeting of Tang Di’s "Zero Kilometers"

Time:July 31st (Saturday) 14:30-16:30

Location:One-way space 2F, B201, Yuanyang Ledigang Cultural Experience Zone, No.58 Lishui Road, Gongshu District

Guest:Tang Di (writer, director), Bad Bird (founder of the Federation)

On July 31st, Tang Di, a writer and film director, and Bad Bird, the founder of the Federation, will visit Hangzhou Ledigang Store in One-way Space to talk about the work Zero Kilometers and share with readers a strange journey from Zero Kilometers.

Hangzhou | Three Sad Tigers: The Birth of a Wonderful Book

Time:July 31st (Saturday) 15:00.

Location:Xiaofeng Bookstore in Mituo Temple, No.533 Tiyuchang Road, Xihu District

Guest:Fan Ye (Associate Professor, Department of Spanish-Portuguese, Peking University Foreign Studies University), Guo Guoliang (Professor, Doctoral Supervisor, School of Foreign Studies, Zhejiang University), Kong Yalei (novelist, translator).

Cabrera Infante is one of the most important writers in Latin America during the "literary explosion". Three Sad Tigers is his most important work. The background of the story is set in Cuba on the eve of the revolution. A group of bohemian artists and writers wander in Havana at night, shuttling between different bars and nightclubs. With this background, Infante fully reproduces the dreamy atmosphere of Havana at the end of 1950s. On July 31st, Fan Ye, the translator of this book, Kong Yalei, the novelist and translator, Guo Guoliang, a professor at the School of Foreign Languages of Zhejiang University, and Yang Quanqiang, the editor-in-chief of Xingsi Culture, will come to the Amitabha Temple Store in Xiaofeng Bookstore to discuss this wonderful work in the history of Latin American literature with readers, and tell about the author Infante and Three Sad Tigers, as well as the difficulties and happiness in the eight-year translation process.

Wuhan | Approaching Qian Jibo —— How the Master of Chinese Studies was Created?

Time:July 31st (Saturday) at 9:30.

Location:Changjiang lecture hall of Hubei Provincial Library, No.25 Gongzheng Road, Wuchang District

Speaker:Wang Yude (former Dean and Professor of School of History and Culture, Huazhong Normal University)

Qian Jibo is one of the most outstanding masters of Chinese studies in the 20th century. What achievements has he made in Chinese studies? Why is his achievements in Chinese studies universally recognized? How did he train his son Qian Zhongshu to become a master of Chinese studies? How did he spend the last ten years of his life in Wuhan? What does his life of Chinese studies enlighten us? This Saturday, welcome to listen to Professor Wang Yude from the School of History and Culture of Central China Normal University about "Approaching Qian Jibo-How the Master of Chinese Studies was Made".

Although Mr. Yu repeatedly publicly denied the rumor that he was banned from being "far ahead" once, and said that because "those four words" were called rotten by everyone, Mr. Yu was unwilling to say it, and there was no fine. Ren Zhengfei, founder of Netcom Huawei, forbids Yu Chengdong to use "far ahead", and every time he mentions "far ahead", he will be fined 10,000 yuan. In this regard, Yu Chengdong has responded that it is a rumor.

Although Mr. Yu repeatedly publicly denied the rumor that he was banned from being "far ahead" once, and said that because "those four words" were called rotten by everyone, Mr. Yu was unwilling to say it, and there was no fine. Ren Zhengfei, founder of Netcom Huawei, forbids Yu Chengdong to use "far ahead", and every time he mentions "far ahead", he will be fined 10,000 yuan. In this regard, Yu Chengdong has responded that it is a rumor. According to the introduction of professional legal practitioners, China’s advertising law aims to curb the excessive propaganda behavior of enterprises, explicitly prohibit the use of extreme words such as "most" in advertisements, and highlight its own products by belittling its opponents. This regulation sets strict requirements on the authenticity, legality and integrity of advertising content, and ensures that advertisements will not mislead consumers, which is its core principle. However, Yu Chengdong’s previous expressions, such as "far ahead", are controversial because they touch the extreme vocabulary boundary of advertising law. To this end, he once chose "far beyond" as an alternative, in order to better meet the requirements of laws and regulations.

According to the introduction of professional legal practitioners, China’s advertising law aims to curb the excessive propaganda behavior of enterprises, explicitly prohibit the use of extreme words such as "most" in advertisements, and highlight its own products by belittling its opponents. This regulation sets strict requirements on the authenticity, legality and integrity of advertising content, and ensures that advertisements will not mislead consumers, which is its core principle. However, Yu Chengdong’s previous expressions, such as "far ahead", are controversial because they touch the extreme vocabulary boundary of advertising law. To this end, he once chose "far beyond" as an alternative, in order to better meet the requirements of laws and regulations. At the same time, Huawei also needs to further strengthen the internal audit and management mechanism to ensure the compliance and integrity of advertising content, so as to safeguard its brand image and consumer rights. Although from the marketing effect, expressions such as "far ahead" and "the best in the world" have really attracted a lot of attention and achieved the purpose of gaining traffic, there are still defects in compliance. To sum up, although Yu Chengdong’s marketing strategy has achieved remarkable results in attracting attention, Huawei still needs to balance the relationship between marketing effect and advertising compliance to ensure the authenticity and integrity of advertising content, so as to maintain its long-term brand image and consumer trust.

At the same time, Huawei also needs to further strengthen the internal audit and management mechanism to ensure the compliance and integrity of advertising content, so as to safeguard its brand image and consumer rights. Although from the marketing effect, expressions such as "far ahead" and "the best in the world" have really attracted a lot of attention and achieved the purpose of gaining traffic, there are still defects in compliance. To sum up, although Yu Chengdong’s marketing strategy has achieved remarkable results in attracting attention, Huawei still needs to balance the relationship between marketing effect and advertising compliance to ensure the authenticity and integrity of advertising content, so as to maintain its long-term brand image and consumer trust. Although Yu Chengdong was nicknamed "Yu Dazui" because he often made exaggerated remarks, most of his "big talk" came true according to the subsequent actual results. This style of doing things makes many users think that his remarks are not pure bragging, but based on objective facts. Although there are many exaggerated elements in them, they are not much different from the facts on the whole.

Although Yu Chengdong was nicknamed "Yu Dazui" because he often made exaggerated remarks, most of his "big talk" came true according to the subsequent actual results. This style of doing things makes many users think that his remarks are not pure bragging, but based on objective facts. Although there are many exaggerated elements in them, they are not much different from the facts on the whole. While other car companies are still trying to catch up with ADS2.0, Yu Chengdong claims that ADS3.0 has achieved "generational leadership". Although it is boastful, this statement is not entirely groundless. For competitors, if we despise Yu Chengdong’s remarks, it may be the moment when they face a crisis. Huawei is famous for its R&D strength. Once it has established its leading position, it will continue to increase its investment and expand its advantages, which is exactly what makes Huawei a "long-distance runner". Therefore, although Yu Chengdong’s remarks are exaggerated, the strength of Huawei in the field of intelligent driving reflected behind it cannot be underestimated.

While other car companies are still trying to catch up with ADS2.0, Yu Chengdong claims that ADS3.0 has achieved "generational leadership". Although it is boastful, this statement is not entirely groundless. For competitors, if we despise Yu Chengdong’s remarks, it may be the moment when they face a crisis. Huawei is famous for its R&D strength. Once it has established its leading position, it will continue to increase its investment and expand its advantages, which is exactly what makes Huawei a "long-distance runner". Therefore, although Yu Chengdong’s remarks are exaggerated, the strength of Huawei in the field of intelligent driving reflected behind it cannot be underestimated.