Billion Amy, Betani and Hua Xi, who will be the first brand of medical beauty skin care?

With the continuous development and subdivision of cosmetics, medical beauty functional skin care products are more and more popular with consumers because of their remarkable efficacy and high safety. In recent years, the market of functional skin care products has been constantly splitting and growing. Which will be the future trend of medical beauty functional skin care products market? Beauty cosmetics? Medical makeup? Or functional skin care products? Who will be the first brand of medical beauty functional skin care products? Beauty lovers who focus on hyaluronic acid? Bettini, a rising star in functional skin care? Or a Huaxi creature that is wet with rain and dew?

Billion Amy, Betani and Hua Xi, who will be the first brand of medical beauty skin care?

Text/Jinkun Beauty Cosmetics Expert Group

At present, the international functional skin care products industry is mainly concentrated in Europe and America, Japan and South Korea. In European and American countries, the market share of functional skin care products, that is, cosmeceuticals, accounts for more than 60% of the whole cosmetic market, and it is still growing every year.

The development of functional skin care products industry in Europe, America, Japan and South Korea is relatively mature, and the most important reason comes from its perfect and effective legislation on cosmetics. Taking the European Union Cosmetics Regulation as an example, the regulation unifies the definition of functional skin care products and the safety evaluation technology of their components, creating a favorable environment for the healthy development of functional skin care products industry.

Since 2005, foreign skin care brands such as Japanese FANCL and American Neutrogena have entered the China market on a large scale, and domestic enterprises have also started to set foot in it.

The proportion of functional skin care market segments in China is much lower than that in Europe, America and Japan, and there is broad room for growth in the future. The market scale of efficacy skin care in China increased from 11 billion yuan in 10 years to 62.5 billion yuan in 17 years, with a compound annual growth rate of 28.16%.

However, compared with the more mature markets in Europe, America, Japan and South Korea, the scale of China’s functional skin care market accounts for a lower proportion of the overall cosmetics market, and in 2017, the market share of functional skin care accounted for 17.3% of the entire cosmetics market; In 2017, among the sales proportion of Japanese pharmacy products, functional skin care products (recognized as cosmeceuticals in Japan) accounted for nearly half, and the market share of functional skin care cosmetics in Europe and America accounted for more than 60% of the entire cosmetics market.

With the continuous development and subdivision of cosmetics, medical beauty functional skin care products are more and more popular with consumers because of their remarkable efficacy and high safety. In recent years, the market of functional skin care products has been constantly splitting and growing. Which will be the future trend of medical beauty functional skin care products market? Beauty cosmetics? Medical makeup? Or functional skin care products? Who will be the first brand of medical beauty functional skin care products? Beauty lovers who focus on hyaluronic acid? Bettini, a rising star in functional skin care? Or a Huaxi creature that is wet with rain and dew?

The surging medical beauty functional skin care products have become the main production force of big beauty cosmetics.

1. The big beauty industry is becoming a trillion-dollar bonus track.

With the sustained growth of the national economy, China’s beauty industry has ushered in a period of vigorous development. While the scale of the beauty industry continues to expand, the marketing methods are also increasingly diversified. Under the background of the continuous development of the mobile Internet and the rising of a new generation of consumers, scene marketing such as live online shopping and innovative cross-border marketing has gradually become a trend.

The domestic beauty industry has been developing strongly recently. The internationally renowned brands that settled in China in the early years and the rising local brands in recent years have, to a certain extent, shared the dividends of the overall rapid development of the industry. The market scale of China’s beauty industry continues to expand steadily. In this process, international brands dominate and play a leading role in the industrial chain development of the domestic beauty market. China consumers no longer prefer overseas branded goods.

As the No.1 brand service provider of the enterprises in Shanghai Oriental Beauty Valley, Guangzhou Baiyun Beauty Bay, China Beauty Town and Beijing Future Beauty City, Jinkun Beauty Expert Group believes that under the intensified competition in the beauty industry, building core product strength in the future is the key to the breakthrough of beauty brands.

In this regard, first of all, it is necessary to select high-quality category tracks. At present, functional skin care and make-up are not only the fastest growing categories, but also have certain barriers, which is conducive to the establishment of differentiated advantages in the future.

Secondly, enterprises need to establish and improve the product development mechanism. On the one hand, enterprises need to make good use of big data and change the roles of products and channel departments to better understand the current consumer demand. On the other hand, with the continuous improvement of production infrastructure, it is even more necessary to enhance the strength of scientific and technological research and development and keep up with the current product outlet;

In addition, in the specific product strategy, "staying right and surprising" will be the core of the future layout of local brands. Brands should not only create large single products to achieve evergreen, but also achieve new customers through "explosive products". Product categories are more about technology+aesthetics, and grasp the general trend of functional skin care products and cosmetics. Since the beginning of this year, the product upgrading trend of the beauty industry has become more obvious than last year. Functional skin care and make-up categories continue to maintain a high growth rate, while high-priced essence products have become the direction of most brands.

As the brand service providers of Shanghai Oriental Beauty Valley, Guangzhou Baiyun Beauty Bay, China Beauty Town and Beijing Future Beauty City, the team of Jin Kun experts predicts that this trend will continue in 2022 next year. Compared with the history of beauty in Korea, Korea has gone through the process of basic skin care-make-up-high-function skin care (functional skin care products and essence products)-micro-plastic surgery. At present, China is rapidly changing from basic skin care to make-up and high-function skin care.

2. Medical beauty functional skin care products are becoming a new force in the beauty industry.

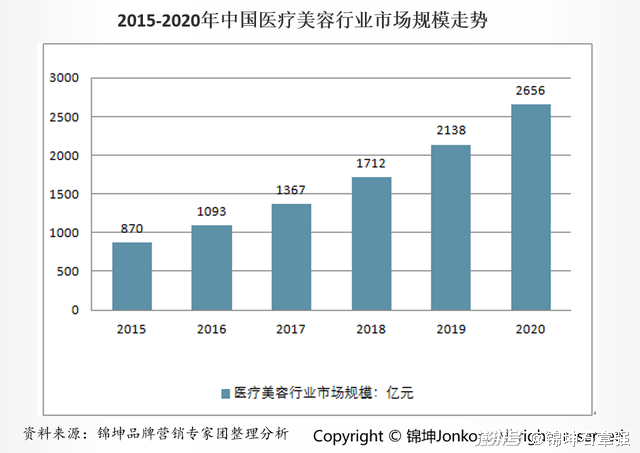

In recent years, China’s plastic surgery industry has developed rapidly, showing great market potential. According to the double eleven data of Ali Health in 2020, the turnover of medical beauty increased by 520% year-on-year. Today, with the rapid development of science and technology, people’s pursuit of beauty is no longer confined to dressing up. It is gradually accepted by more and more Chinese people to realize the transformation of beauty through plastic surgery technology. At present, the market size of beauty institutions in China has exceeded 450 billion yuan, with more than 30 million employees.

China’s plastic surgery industry is growing at an annual rate of 20%, and plastic surgery is growing at an annual rate of more than 20%. In the past 20 years, China’s medical beauty industry has developed into a comprehensive industrial chain covering medical plastic surgery, medical beauty, injection beauty and other fields. China’s plastic surgery industry is growing at an annual rate of 20%, and plastic surgery is growing at an annual rate of more than 20%.

According to whether surgery is performed or not, medical beauty can be divided into surgical beauty and non-surgical beauty, and the latter is mostly a subordinate project of cosmetic dermatology. Non-surgical beauty is gradually becoming the mainstream way to lead medical beauty because of its advantages such as no surgery, quick effect, low risk and reversible effect.

In 2014, the total number of medical cosmetology cases in the world was about 20.2 million, of which surgery accounted for 47.7% and non-surgery accounted for 52.3%. In the specific plastic surgery projects, eyelid surgery, liposuction surgery and breast augmentation surgery rank in the top three, accounting for 43% in total. In non-surgical projects, botulinum toxin and hyaluronic acid injection accounted for about 70%.

3. The market value of 100 billion yuan has become the king label of medical beauty functional skin care products.

Medical beauty, known as the "golden track", continues to be popular in the capital market, especially Aimeike, Huaxi Bio and Betaine just listed, which can be called the "Three Musketeers" of A-share medical beauty!

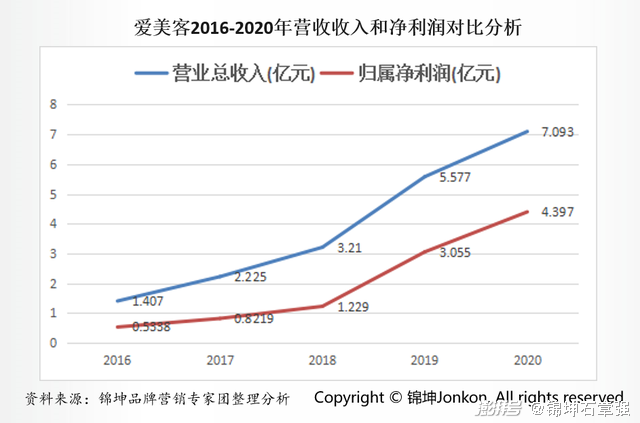

The gross profit is comparable to that of Maotai, and Aimeike, known as the "Woman Maotai", has directly ignited the entire medical beauty industry since its listing in October 2020. At the beginning of this year, Aimeike’s share price once broke through 1000 yuan, becoming the third "thousand-yuan share" of A-shares, and its current market value exceeds 100 billion. The market value of Huaxi Bio, another leader, has also exceeded 100 billion. Betani, the "first stock of functional skin care products" just listed on March 25th, 2021, was greeted with enthusiasm by capital without any suspense. After 9 days of listing, it rose more than 3 times, and its market value exceeded 80 billion yuan. It didn’t take long for the "Medical Beauty Track" to be born. The third "Mr. Billion" was born.

In the mainstream hyaluronic acid market upstream of the industry, imported products are dominant. The high-end hyaluronic acid in the domestic market is mainly supplied by companies such as Aijian and Q-Med, while the low-end market is occupied by the domestic hyaluronic acid A-share giants Huaxi Bio, Aimeike and Haohaishengke.

When the concept plate of medical beauty was agitated collectively, Betani, with the aura of "the first share of functional skin care products", landed on the Science and Technology Innovation Edition on March 25th, and the capital followed, with an issue price of 47.33 yuan, which has now risen to the vicinity of 200 yuan, with the highest increase of nearly 330% and a market value of 66 billion yuan.

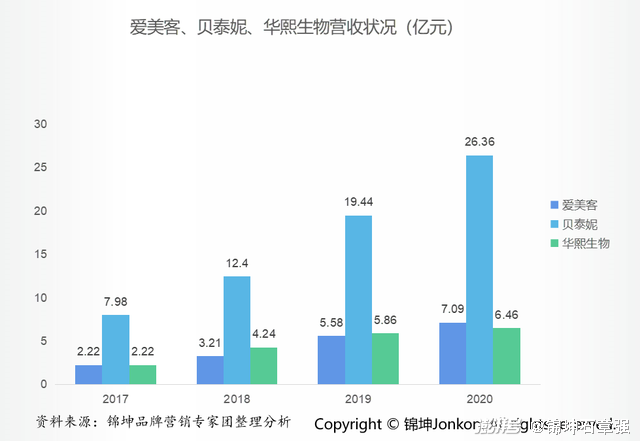

Different from Aimeike and Huaxi Bio, Betani’s products include cosmetics and medical devices, but its skin care product "Winona" is its main source of profit. From 2017 to the first half of 2020, Winona’s revenue accounted for more than 90% of the total revenue, and its comprehensive gross profit margin exceeded 80%, of which the gross profit margin in the first half of 2020 was 81.96%. Obviously, this is another super-high gross margin cosmetics "Maotai".

Previously, Yunnan Baiyao, Pien Tze Huang and Yixian, as well as Aimeike, Huaxi Bio and Betaine just listed, all reached or even exceeded the market value of 100 billion.

The market value of 100 billion yuan has become the standardized configuration of the head brand of medical beauty functional skin care products.

How are Betani, Aimeike and Huaxi with a market value of 100 billion made?

1. Investor Hua Xi

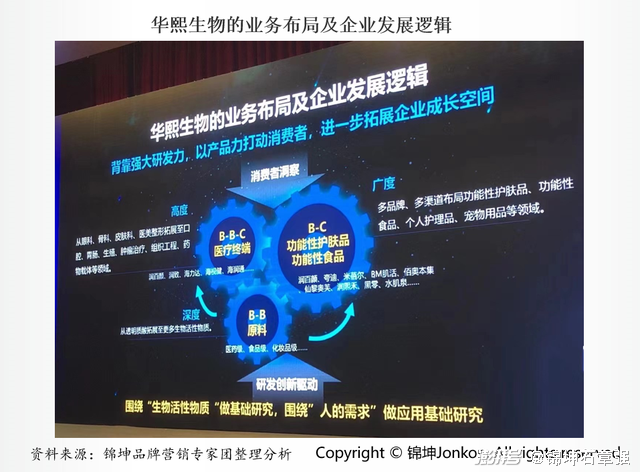

Huaxi Bio is a well-known biotechnology company and bioactive materials company, focusing mainly on functional sugars and amino acids that contribute to human health, and is committed to bringing healthy, beautiful and happy new life experiences to mankind.

Huaxi Bio is a hyaluronic acid industry chain platform company integrating R&D, production and sales. The technology of producing hyaluronic acid by microbial fermentation is in an advantageous position. Relying on the bio-fermentation technology platform and industrialization advantages, a series of BIOACTIVE products with hyaluronic acid as the core have been developed. Among them, hyaluronic acid includes nearly 200 specifications of pharmaceutical, cosmetic and food products, which are widely used in the fields of medicines, medical devices, cosmetics and functional foods. Other bioactive products include icodoline, ergothionine, γ -aminobutyric acid, polyglutamic acid, sclerotium glue gel, natto extract, brown rice fermentation filtrate, etc.

For a long time, Huaxi Bio firmly believes that the vitality of enterprises comes from continuous innovation ability and continuous profitability. By establishing the core position of enterprises in the industrial chain, supply chain and value chain, it ensures the realization of medium and long-term strategic goals. Through the two core technology platforms of microbial fermentation and crosslinking, relying on the company’s scientific and technological strength and product strength, we are committed to becoming the setter and leader of industry standards; Relying on the company’s market power and brand power has become the key link to build control intermediate links in the supply chain; Relying on the company’s scientific and technological strength, product strength and brand strength to build the competitiveness of enterprises has become the core center of the optimal allocation of resources in the value chain.

By the end of 2019, Huaxi Bio’s sales in the raw material market accounted for 39%, accounting for 3 percentage points higher than last year, ranking first in the world. In 2020, Huaxi Bio’s revenue exceeded 2.6 billion yuan, with a net profit of 645 million yuan, a price-earnings ratio of 130 times and a total market value of over 90 billion yuan, which was highly sought after by star institutional investors including JP Morgan, Social Security Fund and UBS (UBS Group AG).

2. Product Wang Aimeike

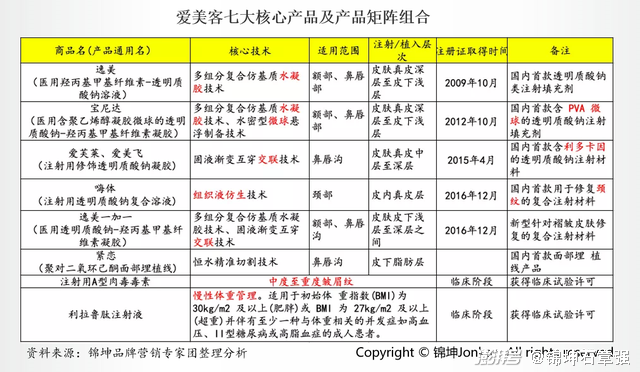

Aimeike is an innovative leading enterprise in the field of biomedical soft tissue repair materials in China, which was established in December 2010. At present, Aimeike has successfully realized the industrialization of sodium hyaluronate injection series products and poly (p-dioxanone) facial implant line, and obtained the medical device registration certificate of sodium hyaluronate injection related products as early as 2009, becoming the first local enterprise to obtain the registration certificate. Aimeike belongs to the medical beauty industry, mainly engaged in the research, development, production and sales of medical beauty hyaluronic acid and other related products, focusing on the medical beauty products business based on hyaluronic acid series, accounting for 99%; The sales scale is larger than Huaxi Bio and Haohaishengke, and it is a well-deserved leader in sub-sectors. Aimeike’s core products mainly include Yimei, Bonida, Aifulai, Aimeifei, Hi-sports, Yimei one plus one, and tight love. The first five products are all hyaluronic acid products, which are different in composition, use position and effect.

In 2019, Aimeike achieved revenue of 558 million yuan, up +73.74% year-on-year, and achieved net profit of 306 million yuan, up +148.68% year-on-year. The compound growth rate of revenue/net profit returned to the mother in 2015-2019 reached 49.44%/103.97% respectively, which can be said to be in a high-speed development stage. In the first half of this year, affected by the COVID-19 epidemic, offline channels were hit to some extent, and profit growth slowed down. However, the growth rate of performance in the second half of this year is expected to accelerate the pace of recovery, and it is expected to continue the high growth momentum next year. "Hippie" is an explosive product of Aimeike, which contributed to the company’s biggest revenue and net profit growth in 2019. In 2019, the income of 240 million yuan increased by 223.6%, accounting for 43.5%; Avery grew steadily after its listing in 2015. In 2019, its revenue was 220 million yuan, up by 15.12%, accounting for 39.27%, and the compound growth rate since its listing reached 61%. Bonida was listed in 2012 and gradually accepted by the market after clinical application in recent years. In 2019, its revenue accounted for 12.1%.

The sales of Aimeike are mainly concentrated in East China, North China and South China, mainly due to the high level of economic development in these areas, the rapid development of the medical beauty market, the relatively concentrated large-scale beauty and medical institutions, and the strong marketing efforts of the company. East China contributed the main income. In 2019, the income was 240 million yuan, up 46.2%, accounting for 42.61%. Followed by North China, the revenue in 2019 was 80 million yuan, an increase of 87.4%, accounting for 14.74%; Central China/Southwest China has great potential. In 2019, the growth rate was 134% and 139% respectively, and the revenue accounted for more than 10%.

3. Technical fan Betani

Winona, the main brand of Betaine, is a powerful brand of medical skin care, which is recognized by dermatology departments of major hospitals in China. At present, the coverage rate in hospitals in various provinces and cities exceeds 70%, and the prescription rate exceeds 2 million cases. The company’s headquarters, raw material collection and industry platform-level R&D center are located in Yunnan, China, the kingdom of medicinal plants, and its operation center is located in Shanghai. It is a medical skin care company embracing the Internet. The head office has Shanghai Betaini Biotechnology Co., Ltd., Wuhan Betaini Biotechnology Co., Ltd., Sichuan Betaini Biotechnology Co., Ltd., Kunming Yunzhuang Biotechnology Co., Ltd. and Winona Skin Medical Beauty Center established in Kunming.

Winona, as the core brand of Betaine, with the support of Betaine’s professional R&D team and hard-core technical achievements, once the product went on the market, it gained a good market response, which opened a niche market for sensitive muscle skin care. Among them, Shu Min special moisturizing cream, as Winona’s star product, has not only been recognized by experts in the industry for its remarkable use effect, but also been recommended by people with sensitive muscles. In the past activities in double 11, the sales of Winona Shu Min moisturizing cream exceeded 180 million yuan, an increase of 75% compared with that of double 11 in 2019, which proved its product strength and reputation with a proud record.

Since its establishment ten years ago, Betani has been focusing on the field of skin health, with the mission of "building China’s skin health ecosystem", devoted to dermatology research and product development, and successfully built scientific skin care into the core competitiveness of the enterprise, with advanced foresight and professionalism.

Betani brings together experts from botany, biology and dermatology at home and abroad to form a research and development team, closely combining with cutting-edge forces, making full use of the advantages of natural resources in Yunnan, a "plant kingdom", and excavating natural and effective active ingredients. At the same time, it has continuously improved its own scientific research ability and product innovation ability, and created an enterprise ecological layout integrating production, marketing, research and study.

What are the hidden worries behind the market value of Betani, Aimeike and Huaxi?

First, Hua Xi’s whole ecology and Zhao Yan’s arrogance and financial skills

1, the whole ecological Huaxi

Huaxi Bio-tech is a bio-high-tech enterprise focusing on biotechnology, with hyaluronic acid as the core, covering a variety of bioactive substances and having a complete industrial chain.

At the 13th Summer Davos Forum with the theme of "Leadership 4.0: The Way to Success in the New Era of Globalization", Zhao Yan, the chairman of Huaxi Group and Huaxi Bio, said at this global gathering of innovation and entrepreneurship that as a high-tech enterprise, Huaxi Bio has its own core technology and strong R&D capability, and has the responsibility to make products that make Chinese proud and respected by the world, and help China national brands to enter the world stage.

"Don’t be a follower, let China brand go out" is not only Huaxi’s development concept, but also Zhao Yan’s brand initial intention.

Zhao Yan believes that as an entrepreneur, we must have four elements: foresight, international vision, overall view and determination. Only with the ability to grasp the trend can we find out where the opportunities are, otherwise we can only be followers, not to mention innovation, and we will lose many opportunities.

If an enterprise wants to develop, its core technology cannot be controlled by people, and it must maintain the ability of continuous independent innovation. In this regard, Zhao Yan deeply felt, "I am personally grasping the company’s research and development, and I demand that a new product be launched every three months. Enterprises must have a sense of crisis, especially the industry leader like Huaxi Bio. You will always be the target of others. If you don’t advance against the current, you will retreat."

Huaxi Bio has been focusing on technological innovation for 20 years. Because it is doing basic research, Huaxi Bio’s R&D investment in new product development, process improvement and technical reserve is not included in the financial accounting of R&D expenses. In fact, in 2016-2018, Huaxi Bio’s expensed R&D expenditure accounted for 3.27%, 3.14% and 4.19% of its revenue, and the total R&D expenditure accounted for 5.99%, 11.01% and 8.25% of its revenue.

Huaxi Biological R&D team consists of 185 people, led by Dr. Guo Xueping, the second prize winner of the National Science and Technology Progress Award. Huaxi Bio has established several R&D centers in Shanghai, Shandong and other places in China, as well as overseas in France, and has established close cooperative relations with universities such as Tsinghua University, Jiangnan University, Shandong University and Harvard University in the United States to jointly develop and research new technologies in special fields.

Zhao Yan believes that national self-confidence comes from cultural self-confidence, product self-confidence and technical self-confidence. On December 10th, 2018, Huaxi Bio launched the "Forbidden City Lipstick" together with the Palace Museum. Six lipsticks were selected from the national treasure color of the Forbidden City. The design of the appearance was inspired by the empresses’ costumes and embroidery, and the world-advanced 3D printing black technology was introduced in the five-color system of green, red, yellow, white and black, respectively, to create the texture of the fabric and the concave and convex feeling of embroidery, which made the national treasure elements more humanistic. With its 20-year experience and technology accumulated in the industry, Huaxi Bio has created an international product that belongs to China and goes global, which not only inherits the excellent oriental aesthetics, but also conveys the real strength of domestic products.

2. Zhao Yan with high financial skills

Behind the rapid development of Huaxi, it is the founder Zhao Yan’s consistent capital, financial technology and genes.

Although Zhao Yan, the chairman of Huaxi Bio, graduated from the Department of Biology, her initial business had nothing to do with hyaluronic acid. After the establishment of Hainan Province in 1988, there was a Hainan fever all over the country. Zhao Yan, a girl from Yunnan, graduated from the Biology Department of East China Normal University, chose to go to Hainan to find gold, do business in garment factories, and invest in land and real estate. By 1992, Zhao Yan sold the garment factories and real estate, got the first bucket of gold and chose to go north.

When she arrived in Beijing, she founded Huaxi Group, started her second business, or made real estate, and won the core area such as Chang ‘an Avenue. Huaxia Bank Headquarters Building, CBD Central World Trade Center, SK Building and even the famous Wukesong Gymnasium were all written by her, and some of them have become landmark buildings in Beijing.

She also dabbled in investment, and successively participated in and invested in Hongta Innovation Investment, First Venture Securities, Jinzhou Bank, Oriental Jincheng, Jinyu Group, Hongkong Yixin, etc. Qian Shengqian’s games became more and more skilled.

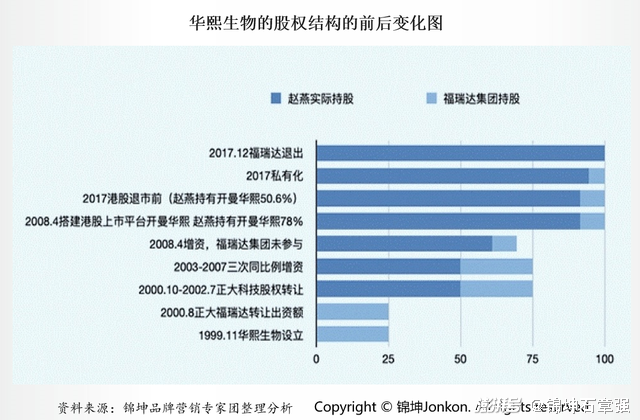

The special opportunity was in 2000, when Zhao Yan went to Peking University for EMBA study. There, Zhao Yan met Guo Xueping, who worked in Freda Biochemistry. At that time, medical beauty was not popular, and hyaluronic acid was mainly used in surgery. However, after hearing Guo Xueping’s remark that "a hyaluronic acid molecule can lock a thousand water molecules", women know women better. Zhao Yan decided to invest in the hyaluronic acid industry and won 50% of the shares of Freda Chemical, and then changed her name to Huaxi Freda Biotechnology Co., Ltd.

Since then, Huaxi Bio-running all the way has developed into the world’s largest hyaluronic acid production and research enterprise in five years. At this time, the cosmetic industry is also on the rise, catching up with a good time.

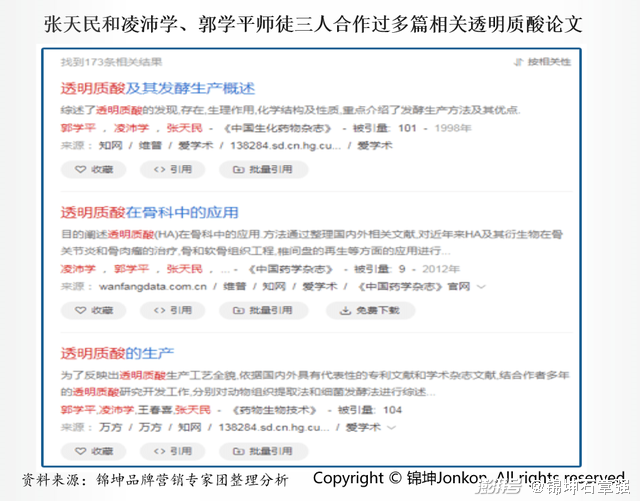

On the Internet, mentioning "the father of hyaluronic acid in China" can find out three people, namely, a professor of Shandong University School of Pharmacy, one of the founders of China Biochemical Pharmacy, and Zhang Tianmin, the chief expert of Shandong Academy of Pharmacy, a general manager of Lushang Group, a researcher of Shandong Academy of Pharmacy and Ling Peixue, director of the National Sugar Engineering Technology Research Center of Shandong University, a chief scientist of Huaxi Biology and a graduate tutor of Shandong University School of Pharmacy, both of whom are students of Professor Zhang Tianmin, and Professor Zhang Tianmin left in 2014. According to the online search, Zhang Tianmin has collaborated with Ling Peixue and Guo Xueping on many papers about hyaluronic acid.

It is said that at the beginning, Guo Xueping studied with Ling Pei, but the fate was so coincidental that Guo Xueping met Zhao Yan, who used the power of capital to expand the scale at lightning speed and won more than half of the hyaluronic acid.

In contrast, Ling Peixue and Freda Group, as the pioneers of the industry, are at a disadvantage in terms of operation and expansion, although their products are good.

In 2007, Huaxi Bio decided to go public in Hong Kong, but it happened that in 2008, it suffered a cold winter. The listing only raised 60 million Hong Kong dollars, which is the company’s net profit for one year. In 2017, Huaxi Bio was privatized and delisted, and Freda also withdrew from Huaxi and completely disappeared from the list of shareholders.

That’s what makes businessmen so powerful. On the one hand, they have a good capital, on the other hand, they are also very concerned about the core technology. In August 2001, Zhao Yan bought out the initial technology of hyaluronic acid for 450,000 yuan from Shandong Institute of Biomedicine.

At that time, the technology of 450,000 yuan has brought Huaxi billions of income and hundreds of millions of net profits every year, which fully explains that even gold must fall into the right hands to shine.

In 2020, Zhao Yan’s family ranked 493rd on the Hurun Rich List with a wealth of 34 billion yuan.

Second, the strong operation of Aimeike and the low-key and concentration of Jianjun

1, strong operation of beauty customers

Aimeike’s gene wants to be a First-in-class product.

As the helm of domestic hyaluronic acid leader Amy, Jianjun’s entrepreneurial road is not complicated. Aimeike, formerly known as Beijing Yingzhihuang Biotechnology, was established in 2004 with the joint contribution of Yao Jing and Cheng Chao, with a registered capital of 1.5 million yuan. Yao Jing was Jian Jun’s husband. At that time, he held 50% of the company’s shares, and Jian Jun was a director.

In 2004, Jian Jun returned to China to set up Aimeike. At that time, European, American and Korean companies dominated the supplier market of facial fillers, and China hyaluronic acid could only rely on imports. Yimei, the first product independently developed by Aimeike, obtained the medical device registration certificate and went public in 2009, and Aimeike became the first domestic enterprise to obtain relevant qualifications. Aimeike achieved high growth through explosive volume. In 2016, the body made by Aimeike became the only hyaluronic acid for injection in China, which boosted its income from 34 million yuan in 2017 to 243 million yuan in 2019, and the income in 2019 continued to increase by 223.6% year-on-year.

At present, Aimeike focuses on medical beauty track, and its market share in medical beauty hyaluronic acid is the highest in China. Since its establishment, Aimeike has been guided by technological innovation, based on the research and development mode of integration of production, learning, research and medicine, and built a platform for the transformation of biomedical materials products by building the Beijing Engineering Laboratory of biodegradable new materials.

Although Amy has so many firsts, its income scale is much smaller than that of Huaxi and Haohai, because it only does medical beauty industry, and the latter two also involve medical care, ophthalmology, orthopedics and other fields. Focus also has the advantages of focus, single business, concentrated efforts to break through and high efficiency. Therefore, although the income of Aimeike is only 1/3 of that of Huaxi and Haohai, the profit level is not much different from Haohai, which is 1/2 of that of Huaxi.

Under the leadership of Jian Jun, Aimeike already has a management and technical team with an international vision, paying close attention to the research results and development trends of the industry, grasping the latest development trends and application directions of international biomedicine, and combining with the company’s reality, formulating a forward-looking technology and product development strategy, which laid the foundation for the company to obtain the first-Mover advantage in the industry and the future sustainable development.

2, highly focused Jane army

The medical beauty market is booming, and beauty lovers seize the opportunity to grow rapidly. In 2020, revenue increased by 27% and net profit increased by 44%. In the first half of 2021, revenue increased by 161% and net profit increased by 189%.

Medical beauty makes huge profits. The gross profit margin of the leading beauty lover is as high as 92%, and the net profit rate is as high as 61%. It is known as the woman Maotai. This is inseparable from the high concentration of Aimeike and founder Jian Jun.

Aimeike has a strong R&D capability, and has seven Class III medical device registration certificates, among which the large single product "Hip Body" is the only neck tattoo repair product approved for listing in China.

Medical beauty injection directly acts on human body, which has high risk and belongs to Class III medical devices. Class III medical devices have the highest safety level, and they must pass phase III clinical trials from project establishment to registration certificate. This process takes a long time and costs a lot of human and financial resources. It usually takes 5-7 years or even longer to get the registration certificate. More importantly, clinical trials are not necessarily successful, and there is a greater risk of failure in the middle.

It is extremely difficult for new entrants to enter the medical beauty market, because the time cost is unavoidable. This is equivalent to forming an access barrier from the license plate level, which blocks competition to some extent.

Aimeike has obtained seven Class III medical device registration certificates, which has obvious first-Mover advantage. Once the product opens the market, it is lying down to make money.

Take Heiti as an example. In the market of neck tattoo repair, only this product is approved, which is equivalent to monopoly. This is why Amy doesn’t have to do much marketing, and the products are still so popular.

If the license that has been obtained constitutes a moat, then Aimeike’s research and development ability is deepening and widening the moat all the time. This research and development ability is reflected in the originality of products and the efficiency of license approval.

In 2009, Aimeike obtained the first registration certificate of hyaluronic acid class III medical devices in China. Since then, many products have been the first in China, such as hi-body and Tong-Yan needles. In addition, the company has obtained a medical beauty registration certificate every two years on average, and its research and development efficiency far exceeds the industry average. At present, it is the enterprise with the largest number of licenses in China.

Can have such excellent research and development results, lies in a strong research and development team. By the end of the first half of this year, Aimeike had 95 R&D personnel, accounting for 22% of the total employees, about half of whom held master’s degrees or above, and the team’s working experience in medical beauty exceeded 8 years on average. In the first half of the year, R&D expenditure was 44 million yuan, a year-on-year increase of 112%. It can be seen that while Aimeike’s performance has grown rapidly, it has also increased its investment in research and development.

On the backup product line, Aimeike’s research products have a good market space, such as anti-wrinkle artifact botulinum toxin and liraglutide injection for slimming and shaping.

Third, Bettini’s fine products and Guo Zhenyu’s passion and technology.

1. Betaine of refined products

Bettini’s vision is "to bring health and beauty to people"

Winona is a veritable top-notch brand in anti-allergic skin care. Betani, who was the sole trader of this "online celebrity" brand, was born out of a loss-making project of Dianhong Pharmaceutical. After more than ten years’ development, Betani has successfully landed on the Growth Enterprise Market (GEM) and secured the first place in the functional cosmetics track. As the founder and chairman of Betani, Guo Zhenyu had a wonderful experience. He not only "touched the stone and turned it into gold", but also bet "won" 2 kilograms of gold from sequoia capital china partner Zhou Kui.

In 1988, Guo Zhenyu, a lecturer at Yunnan University, was given the opportunity to study abroad. "My monthly salary is about 60 yuan. At that time, Yunnan University sent me to study abroad at public expense and spent $10,000 as a scholarship from the fund of local foreign exchange study enterprises in Yunnan Province. At that time, Yunnan’s economy was relatively backward, and I could still spend so much money to send me to study abroad. I must serve my hometown after I finish my studies. " Guo Zhenyu recalled. After Bayer bought Dianhong Pharmaceutical, Guo Zhenyu thought for a long time. Looking back on the first half of his life, Guo Zhenyu found that he was "discovering diseases" (biomedical engineering, doing medical device research) and "treating diseases" (taking charge of Dianhong Pharmaceutical as a pharmaceutical company). He decided to expand his career around "preventing diseases" in the second half of his career. Guo Zhenyu finally found the point of "building China’s healthy skin ecology". Bringing health and beauty to people is Guo Zhenyu’s long-term goal, while the short-term goal is to focus on creating Winona, a leading product and brand in sensitive muscle track.

Guo Zhenyu believes that any sub-category in China, a big market with a population of 1.4 billion, can become an international brand as long as it is done with heart. You must have the thinking of becoming the world’s number one, and use the world’s number one standard to demand and position your own brand.

Bettini made clear the multi-brand strategy at the beginning, but now Winona may be the only one in the public view. Did Bettini give up multi-brand? No. It is Guo Zhenyu who wants to focus and refocus, and first dig deep into the sensitive skin to stabilize the leading position. Therefore, in the short to medium term, Betani will still focus on sensitive muscles, gradually strengthen the construction of private domain traffic, and strive to continue to make Winona bigger. "

After the listing, Betaine will also start to build new platforms and brands, including incubating new brands and encouraging internal entrepreneurship, and at the same time, use Betaine’s accumulated R&D capabilities, brand building capabilities and supply chain capabilities to support the incubation of internal startups.

Guo Zhenyu has a clear layout for the future: Betani is not only an enterprise that produces skin care products, but also an enterprise that is located in the whole skin health ecology, and cultivates a closed loop of skin health consumption ecology in the process of "circle selection-circle destruction-circle reconstruction".

2. Guo Zhenyu, a technology freak.

If you want to know Winona, you can’t avoid one person. That’s the man behind it, Guo Zhenyu.

Zhou Kui, the managing partner of investor Sequoia Capital, once described his impression of Guo Zhenyu as "enthusiastic, active, broad-minded, ambitious, generous, educated and energetic".

Guo Zhenyu, an academic, was a tenured professor at George Washington University in the United States. He was also the first batch of people who resigned from the tenured professor in the United States and returned to China to start a business after the reform and opening up. He served as the president of the World Association of Self-medication and the President of China Association of Over-the-counter Drugs, and led the launch of International Self-care Day.

Guo Zhenyu’s broad vision and lofty goals were first reflected in the reform of Dianhong Pharmaceutical.

In 2003, Guo Zhenyu airborne Dianhong Pharmaceutical Co., Ltd., first of all, handed in a report, put forward its own business objectives, and claimed that it would be successful to finish class. As soon as Guo Zhenyu entered Dianhong, it began to integrate resources in two aspects. One is to adjust the multi-brand strategy to concentrate resources to build a brand and make "Kang Wang" a household name; On the other hand, it is to integrate marketing channels and streamline more than 20,000 dealers into 500. Under the leadership of Guo Zhenyu, Dianhong Pharmaceutical’s sales increased from less than 200 million to over 1 billion, and soon became the leader of Yunnan pharmaceutical industry and entered the national echelon.

In the wave of transformation from pharmaceutical industry to daily health, Guo Zhenyu had an early insight into the opportunities in the functional skin care market. At the beginning of 2006, Guo Zhenyu led Dianhong Pharmaceutical to enter the daily chemical market, and "opening up a new way of daily chemical with functional daily chemical products" was the route of Dianhong in that year. In 2007, Winona established a project and became one of the daily chemical brands of Dianhong Pharmaceutical in Shanghai.

From 2011 to 2014, during the process from planning the listing of A shares to being acquired by Bayer in Germany, Winona was separated for losses and transferred to Betaine. In 2014, Guo Zhenyu stepped down as the chairman of Dianhong Pharmaceutical Co., Ltd., and became the controlling shareholder of Betaine by acquiring Nona Technology, and became the chairman of Betaine, completing the gorgeous turn from a pharmaceutical company to a skin care company.

In 2021, when Guo Zhenyu reviewed Winona’s development process, he described Winona as a "designed" brand. Ten years ago, he basically anticipated Winona’s success today.

Who will be the real king of 100 billion yuan and the first brand of medical beauty functional skin care products?

1. Is Huaxi an excellent investor in bioactive substances or a platform vendor?

1) Platform vendors:

Huaxi Bio is a well-known biotechnology company and bioactive materials company, focusing mainly on functional sugars and amino acids that contribute to human health, and is committed to bringing healthy, beautiful and happy new life experiences to mankind.

As a hyaluronic acid industry chain platform company integrating R&D, production and sales, Huaxi Bio’s microbial fermentation technology is in an advantageous position. Relying on the bio-fermentation technology platform and industrialization advantages, it has developed a series of BIOACTIVE products with hyaluronic acid as the core, including nearly 200 specifications of pharmaceutical, cosmetic and food products, which are widely used in the fields of medicines, medical devices, cosmetics and functional foods. Other bioactive products include icodoline, ergothionine, γ -aminobutyric acid, polyglutamic acid, sclerotium glue gel, natto extract, brown rice fermentation filtrate, etc.

For a long time, Huaxi Bio firmly believes that the vitality of enterprises comes from continuous innovation ability and continuous profitability. By establishing the core position of enterprises in the industrial chain, supply chain and value chain, it ensures the realization of medium and long-term strategic goals. Through the two core technology platforms of microbial fermentation and crosslinking, relying on the company’s scientific and technological strength and product strength, we are committed to becoming the setter and leader of industry standards; Relying on the company’s market power and brand power has become the key link to build control intermediate links in the supply chain; Relying on the company’s scientific and technological strength, product strength and brand strength to build the competitiveness of enterprises has become the core center of the optimal allocation of resources in the value chain.

2) Investors:

Huaxi Bio, formerly known as Huaxi Freda Biomedical Co., Ltd., is a state-level high-tech enterprise founded by Huaxi International Investment Group Co., Ltd. Since the research on the production of hyaluronic acid by fermentation was first carried out in China in 1990s, Huaxi Bio has devoted itself to the research and development in the field of biotechnology, not only making in-depth exploration and innovation in the research and application of hyaluronic acid, but also increasing the development of related bioactive products.

As a high-tech enterprise with hyaluronic acid microbial fermentation production technology as its core, Huaxi’s biological business covers raw materials, medical terminal products, functional skin care products and other fields. Huaxi Xinyu holds 65.86% of the shares as the largest shareholder of the company; China Life Chengda, a subsidiary of China Life Insurance, holds 8% of the shares as the second largest shareholder; Winning Ruiwuyuan holds 7.69% as the third largest shareholder. In addition, there are more than a dozen institutions such as Zhongjin Jiatai, Minsheng Trust, Ai Ruisi Medical, Ruizhi Medical and Zhuhai Jinyongming.

The whole industry chain platform is the biggest advantage for Huaxi. With its strong foundation, it has developed rapidly in the field of hyaluronic acid and functional skin care products, and then went public for investment, etc. Now Huaxi has become a powerful capital investment platform enterprise. Therefore, Huaxi is not only an excellent platform vendor, but also an excellent investor. It is a good choice to do the same, but how to grasp the structure and rhythm is a test of the founder’s determination and initial heart.

2. Can Aimeike become Wuxi PharmaTech in the medical beauty industry?

Aimeike is an innovative leading enterprise in the field of biomedical soft tissue repair materials in China. At present, it has successfully realized the industrialization of sodium hyaluronate series products for injection and facial implantation line of poly (p-dioxanone), and obtained the medical device registration certificate of sodium hyaluronate injection related products as early as 2009, becoming the first local enterprise to obtain the registration certificate. Aimeike belongs to the medical beauty industry, mainly engaged in the research, development, production and sales of medical beauty hyaluronic acid and other related products, focusing on the medical beauty products business based on hyaluronic acid series, accounting for 99%; The sales scale is larger than Huaxi Bio and Haohaishengke, and it is a well-deserved leader in sub-sectors.

Judging from the R&D projects of Aimeike Reserve, there are many products under research and many potential products in the future. Judging from the progress of application, the products currently in the last link of the registration process are medical sodium hyaluronate gel containing modified poly-L-lactic acid microspheres (face filling) and medical poly-carboxymethyl glycosaminoglycan gel (anti-adhesion for surgery), and these two products are in a higher ranking in the market. Among them, medical sodium hyaluronate gel containing modified poly-L-lactic acid microspheres (commonly known as Tong Yan Zhen in the market) is expected to become the leading injection filling products containing poly-L-lactic acid microspheres in China. The reserved products are also very market-impacting.

Generally speaking, the medical and beauty industry, especially the upstream raw material industry, has high barriers, and the downstream customers are an addictive consumption with strong stickiness. As a domestic industry leader, it has high technology content and will grow rapidly into an international leading company with the development of the industry in the future. In 3-5 years, with the standardization of the industry, the concentration will be further improved. In 3-5 years, the company has more than 10 times the growth space, and the future can be expected!

3. Can Bettini’s small goal of building the first brand of skin functional skin care products be achieved?

Since its establishment ten years ago, Betani has been focusing on the field of skin health, with the mission of "building China’s skin health ecosystem", devoted to dermatology research and product development, and successfully built scientific skin care into the core competitiveness of the enterprise, with advanced foresight and professionalism.

Betani brings together experts from botany, biology and dermatology at home and abroad to form a research and development team, closely combining with cutting-edge forces, making full use of the advantages of natural resources in Yunnan, a "plant kingdom", and excavating natural and effective active ingredients. At the same time, it has continuously improved its own scientific research ability and product innovation ability, and created an enterprise ecological layout integrating production, marketing, research and study.

Bettini is a professional cosmetics manufacturer with Winona brand as the core, focusing on the application of pure natural plant active ingredients to provide mild and professional skin care products, focusing on sensitive skin, and deeply integrating with the Internet in product sales channels.

In the fierce competition environment, Betani chose a differentiated track to participate in the market competition in combination with her own advantages to avoid the homogenization of products. Betaine’s products are characterized by the effective application of pure natural plant active ingredients. Among them, Shu Min series products with the highest sales share are aimed at people with sensitive muscles and are branded with international brands such as Vichy, la roche-posay and Avene. Affected by air, environment, pressure and other factors, the population with sensitive muscles has a large base and a growing coverage. More than 35% of women in China belong to the population with sensitive muscles. This population has a huge demand for skin improvement, which not only has great consumption power, but also has higher customer stickiness. Take Winona’s official flagship store (Tmall) as an example, the repurchase rate of the company’s products has been close to 30% in the past three years.

Betani’s excellent record is enough for us to foresee its future, and it has firmly locked the hearts of consumers from the concept of the enterprise to the inclusive marketing method. Betani has won the titles of "the first brand of functional skin care products" and "the first brand of domestic products", so will it be far from the first brand of skin functional skin care products?

Aimeike, Betani and Huaxi, the three major functional skin care brands, have a market value of 100 billion and a revenue of 1 billion, which is just the beginning.

As the No.1 brand service provider of the garden enterprises in Shanghai Oriental Beauty Valley, Guangzhou Baiyun Beauty Bay, China Beauty Town and Beijing Future Beauty City, Jinkun Beauty Expert Group believes that as a challenger, Aimeike, Betani and Huaxi have successfully defeated the industry giants. Now, Aimeike, Betani and Huaxi, as defenders, have to meet new market challenges and possible new brand transcendence.

On the one hand, international brands are trying their best to save their market share. Foreign brands such as Vichy and Avenues have made renewed efforts. While increasing investment in e-commerce, they announced that they would return to the pharmacy channel and open a new O+O model (Online+Offline). In recent years, L ‘Oré al Group, which is behind Vichy, has continuously acquired cutting-edge functional skin care brands in the world, and introduced them to China one after another. Through the construction of brand matrix, it has formed a encirclement of Aimeike, Betani and Huaxi.

On the other hand, it is the pursuit of local brands. Shanghai jahwa, a traditional veteran, invited Pan Qiusheng, who is good at recovering lost territory, as the new head, and Yuze’s sales soared in the past two years. In addition, cutting-edge brands are active, and cooperative brands of obstetrics and medical research and dermatologists have established brands, which have been helped by capital. The success of Aimeike, Betani and Huaxi has made the capital operation of the beauty industry more intense, and Ximuyuan, who also wants to seize the efficacy skin care market, has only been on the line for two years, and has obtained 7 rounds of financing in succession, with a valuation of 4 billion.

Whether it is Huaxi’s confident attitude towards domestic products, the dedicated spirit of beauty lovers, or Bettini’s scientific and technological feelings, it indicates the fiery prospect of the domestic functional skin care products market and the bright future of the medical beauty industry!

The market value of some of these brands has exceeded 100 billion, and some of them have followed closely. The domestic market has been opened, and the revenue of 10 billion yuan is close at hand. However, these are not the goals. With the younger age structure of consumers, the future of the medical beauty skin care products market is incalculable!

The brutal competition of magnitude between truly professional players may have just begun!

(This article comes from some related contents of the report on the brand development of China cosmetics industry, which was commissioned by the relevant state departments by Jin Kun. Jinkun is a well-known brand service provider in China, focusing on building the first brand of industrial parks and enterprises, and providing chain and Internet brand marketing services. It has successively coached and served more than 400 specialized new enterprises, more than 300 industry first brands, more than 200 listed companies, more than 100 city brands, more than 50 China top 500 companies and more than 20 world top 500 companies. Shi Zhangqiang is the founder of Jinkun brand, the founding secretary-general of Shanghai Brand Committee, the brand expert member of Shanghai Municipal Government and the general manager of the project of China Cosmetic Industry Brand Development Report. He has deeply coached and served four 100 billion-level beauty production cities, including Shanghai Oriental Beauty Valley, Guangzhou Baiyun Meiwan, China Beauty Town and Beijing Future Beauty City. )