The number of fans is 5 million. Brother Donkey is under great pressure after getting rich overnight.

Claiming to have no face value and no culture, understanding the real circle of friends through the network.

In the webcast room, fans called him "Brother Donkey". At 9 o’clock every night, tens of thousands of fans have been "in place" on time, waiting for his appearance. In the online world, no one cares about his real name.

"Brother Donkey" is actually only 28 years old this year, and looks a little vicissitudes. In his own words, "people in their twenties look like they are almost forty years old". However, it doesn’t matter. Anyway, he didn’t take the common route of sucking powder by facial value at all. A year ago, he began to put some self-made hilarious ultra-short films on a video App, usually for more than ten seconds. Unexpectedly, it became popular overnight, and the number of fans soared from tens of thousands to more than five million now, making it the top three fans in this video App, online celebrity.

A year ago, he was only the owner of a small tobacco hotel in Shijiazhuang. A year later, when he came to Guangzhou, his life was undergoing earth-shaking changes.

Text, map/Guangzhou Daily reporter Du Anna

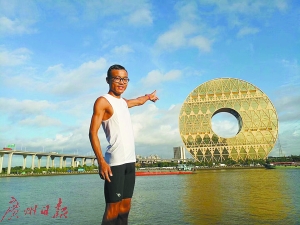

In a large building on the edge of Guangzhou, the reporter found such a super online celebrity who would get lost in his own community.

I have just moved to the community for almost two months, and Brother Donkey usually just stays at home. At the appointed time of the interview, he was driving around the community in his own sports car with more than one million yuan, and he still couldn’t find the appointed place.

Brother Donkey is 1.85 meters tall, with a white T-shirt and a pair of blue shorts. He dresses casually. Brother Donkey’s signature dress is a gold chain thicker than his fingers. He said that he didn’t buy it after online celebrity developed. "We’ll just show how much money we have at home.".

A year ago: urban "Jianghu" youth

No one saw that Brother Donkey would be where he is today, including himself.

Brother Donkey used to be a small owner of a tobacco hotel in Shijiazhuang, and the actual investor of this store was his father. In Brother Donkey’s eyes, Dad is a thoughtful businessman, from greenhouse cultivation in the countryside of Mudanjiang in Northeast China to vegetable trade, and then to running a restaurant in Shijiazhuang, step by step, making him a "rich second generation" — — Brother donkey

Speaking of his past life, he described himself as a playboy who was born in the countryside and had a primary school education, and became a city youth and wandered on the edge of mainstream culture.

Xiao Pang, his friend for many years and now his partner, thinks that Brother Donkey was famous in the local area before he became a super online celebrity, and his status in the Jianghu should not be underestimated. Xiao Pang used to be a waiter in the restaurant of Brother Donkey’s father. He was attracted by Brother Donkey’s personal charm and stopped working as a waiter. Every day, he was inseparable from him.

Three-person "donkey family class"

Brother Donkey’s current creative team also has a core member named Jia Erchang. The trio formed the present "Donkey Family Class". Jia Er is often a wise man in the eyes of Brother Donkey. He is thoughtful and far-sighted. "When he saw that I was going to be popular, he quickly went to my restaurant and invited me to dinner. Finally, the three of them stuck together."

Brother donkey, it’s purely fun to go online and become popular. Two years ago, someone told him that there was a fun video software that was especially suitable for him. Brother donkey’s eyes shine, and he is like a duck to water for a person who usually takes "amusing" as his hobby.

In the original Caotai team, Brother Donkey’s wife was a photographer, Brother Donkey was the protagonist, and almost all the chefs, waiters and logistics staff in his father’s restaurant made guest appearances in his hilarious jokes.

In order to attract attention, Brother Donkey has taken great pains. He scoured the Internet for props, bought a giant deck of playing cards, recorded several jokes, simulated several "landlords" games, and satirized how the "two-short" players turned their excellent cards into bad cards in the poker field.

The video broadcast effect was somewhat unexpected. One of the videos reached several million hits, and the fans of Brother Donkey rose by 30,000 to 40,000.

A year later: a fire broke out.

Brother donkey was very excited after a good game. Brother donkey said that the original works now seem to be the most satisfactory. He said that even if he looked back now, he would still laugh.

In the more than 200 works of "Donkey Family Class", most of the contents are from their original works, and some of them are remakes. Brother Donkey mainly creates hilarious short videos of more than ten seconds, while Jia Erchang writes "feature films" of about two minutes. Over the past two years, they have formed a tacit understanding.

The soaring number of fans

My brother remembers the excitement of tens of thousands of fans for the first time. At that time, he answered questions from fans. Every time the powder rises, he is even too happy to sleep.

Now, "a little numb", rising powder has become a burden. During the interview, he took out his mobile phone and took a look. In just one hour, on the video playback platform, it has already increased by 1,263. According to the statistics of Brother Donkey, the speed of his powder increase is almost 10,000 people a day.

The comments and private messages on the video playback platform are basically too busy for Brother Donkey.

In addition, hundreds of people request to add his WeChat friends every day. My brother didn’t look at his mobile phone for a few minutes, and the invitation to add WeChat friends has already been arranged in a "long queue". And most of the requests, the final result is ignored. Only some fans who brush their screens and "give gifts" frequently during his live broadcast may be added as WeChat friends by him.

Seeing that Brother Donkey is on fire, there are also many platforms to ask him to "move". He found that his "charm" is not infinite, the number of fans can’t come up, and the number of viewers during live broadcast is not as good as that of the existing platform.

I once thought about giving up.

In a year, Brother Donkey has gone from a small owner of a tobacco hotel to a super online celebrity now. The income has gone from 1.2 million yuan a year to 700,000 yuan a month now. He himself said that it was almost a rich man overnight.

"However, everyone only sees the scenery of success, but can’t see our sadness and suffering." Brother Donkey has refused to place advertisements when recording hilarious short films since he became online celebrity. Because of this, fans will look down on us.

But this principle has also been broken. That difficult time almost ruined Brother Donkey’s road to super online celebrity. Brother Donkey said that in fact, the monthly income of 700,000 to 800,000 yuan is only this year. For a long time, they not only earned nothing, but also posted it upside down.

However, what hit them hard was not the investment. "After all, the cost is not high, just a few people eat and some props", but the people around them don’t understand. "Jia Erchang’s parents saw their son with me, making jokes in the Woods all day. They are almost thirty, and they can’t earn a penny. Like a fool, they are anxious."

Brother donkey said, "My wife is also anxious. Is it silly to say that you pat all day?"

Dialogue with Brother Donkey: "I am a very wonderful online celebrity"

Guangzhou Daily: Did you ever think that you would become online celebrity?

Donkey: I didn’t expect that. I thought about 110 thousand ways to get rich, but I didn’t expect this one.

Guangzhou Daily: What’s your income now?

Brother Donkey: The monthly income is about 700,000 to 800,000 yuan. Most of the money was sent by fans in the webcast room. A live broadcast usually earns about 50 thousand yuan.

Guangzhou Daily: How many "zombie fans" do you think are among your fans?

Brother Donkey: There must be, because some people don’t interact with each other, and it won’t be long before they go offline. But each paragraph is played more than 2 million times a day. There should be no moisture in this.

"I don’t want to go too high, I don’t have great ability."

Guangzhou Daily: Are you satisfied with your work?

Brother donkey: I think the early works are better. I found the previous jokes interesting myself, but the current ones are just so-so. Jiang Lang is at his wit’s end.

Guangzhou Daily: What is your dream?

Brother donkey: I hope that one day a famous director will take a fancy to us and be able to make a movie. So we don’t play junk advertisements, but also for this dream.

Guangzhou Daily: Is there a great director looking for you now?

Donkey: No. But there are too many people looking for us to make micro-movies. We need to watch the script.

Guangzhou Daily: Do you still want to make a film by a famous director?

Donkey: I don’t want to. Now we know that the entertainment circle is not what we think. People like us can just make a big online movie. It’s better to be a chicken head than a phoenix tail. I don’t want to go too high, I feel that I don’t have that great ability, and I feel that I have reached the bottleneck.

Guangzhou Daily: Will you be anxious now?

Brother Donkey: Actually, I’m a little depressed after a long time. Since I came to Guangzhou, I only slept a few hours a day. I often shut myself in my room, watch WeChat, Weibo’s public platforms, find some meaningful jokes, and some popular content on the platforms. I feel too tired, just look at the car, and I can’t stop thinking for a moment. At present, the whole operation team has nearly 20 people, including shooting, editing, chef, logistics and bodyguards. The salary of each person is 10 thousand yuan a month, which is not a small expense.

"Second-and third-tier stars are no match for me."

Guangzhou Daily: Why did you come to Guangzhou?

Brother Donkey: In the past, during the live broadcast, it was a clothing factory in Guangzhou that provided me with clothes for free. Later, I came to this boss and felt that Guangzhou was very developed, and I picked up money casually. I cooperate with this clothing factory and act as their agent. I only say it once a day in the live broadcast room, and my micro-signal is filled up. Hundreds of people are designated customers. I sell clothes for a clothing factory and often run out of stock as soon as I sell them. I have used several micro-signals. Before, someone put my WeChat on the homepage of the video playback platform, and it was added to 5000 people at once. The WeChat card could not be opened and had to be invalidated. I have five or six micro-signals now, each of which is thousands of people.

Guangzhou Daily: Are you satisfied with the current situation?

Brother Donkey: oh, let a man of spirit venture where he pleases. If it doesn’t work right now, I’m happy, too. I’ve already enjoyed this process, which is quite exciting. I have reached such a "stage". Now that my fame has spread, people will not forget me for at least two or three years. For example, I can make movies. I still have some brand shares, and I will definitely not return to my original position.

Guangzhou Daily: Everything has a life cycle. How do you plan your future?

Brother Donkey: I can accept my disciples now and throw my popularity at them. Besides, I can invest in making movies.

Guangzhou Daily: Are you a little different from ordinary online celebrity?

Brother Donkey: Yes, I am a very wonderful one. To face value without face value, to culture without culture, to talent without talent, primary school culture.

Guangzhou Daily: Where are your fans mainly concentrated? Who are they?

Brother Donkey: It’s all over the country. If you travel all over the country, you just need to fill up your car and get fans everywhere. Just let me know when you broadcast live. There are fans in all fields, including business owners, social workers and public officials.

Guangzhou Daily: You look like a movie star now?

Brother Donkey: Second-and third-tier stars can’t compete with me. I think it’s almost 1.5 lines now.

"The Internet has made me see the reality clearly"

Guangzhou Daily: What’s your daily routine?

Brother Donkey: I sleep at dawn, get up in the afternoon and work at night almost every day.

Guangzhou Daily: What is the content of the live broadcast?

Brother Donkey: When fans ask me questions, I say what I think, which is very straightforward. I don’t hide, I don’t lie. Because telling a lie requires hundreds of lies to make up for it.

Guangzhou Daily: How will you relieve stress?

Brother Donkey: I’m going to open a martial arts school. You can vent when you have time.

Guangzhou Daily: What’s your biggest feeling after you became online celebrity?

Brother donkey: the internet is a magnifying glass in reality, which makes me see many people clearly. For example, the brothers who used to play together, when they saw that I was popular, came to me and said that they would kick my current partner out. I certainly wouldn’t. They called names behind their backs and said everything.

When I first started filming, I asked some friends for help. They not only didn’t help but also laughed at me. Now that I am popular, they all come back to me.

Reporter’s notes

He lives in a "parallel world"

After listening to Brother Donkey’s story, many people expressed their sighs. Is the Internet a world parallel to reality? Why is he popular?

During the interview, the performance of this super online celebrity made people feel extremely fickle. In the early communication, half of the people were "missing", and the interview site was temporarily changed. It was extremely unpunctual when the interview time came.

After a great test of patience, a guy who is 1.85 meters tall, with a thick gold finger chain and driving an Audi R8 sports car appeared in front of the reporter.

This has 5 million fans, and the super internet celebrity is full of apologies. It turns out that he just moved here not long ago, and his long-term day-and-night work and rest, coupled with the living habits of the super house, have never wandered around the community. So I drove around the community for several times and still couldn’t find the agreed place.

Brother donkey’s characteristic is to constantly subvert your inherent idea of online celebrities.

Finally, the interview had to be conducted on the side street of a stuffy and humbled shop. He parked his luxury car on the side of the road and walked into the roadside shop without hesitation. While not forgetting to joke, he said that he was originally a peasant, and he felt very adapted to this environment.

In the whole interview, he did not shy away from talking about the dilemma he faced, and reached a bottleneck in his creation. Although his income has reached a new peak, the higher he stands, the more lonely he feels, even if he has millions of fans.

He has no pushers or advisers, so he can only think for himself. He looks heroic, but in the face of his future, he looks conservative and worried. He doesn’t like some online celebrity, keen to expand the scale. He is satisfied with the flexible and free creative team at present.

After the tornado in Jiangsu, he took 30,000 yuan and drove from Guangzhou at 2 o’clock in the middle of the night, driving for more than 20 hours, and went to the hospital in the disaster area to give money to the victims. He didn’t record any video because he was afraid of being said to be a show, and he didn’t mention anything on the webcast platform. That’s what he wants.

In the end, he said frankly that it was not that he didn’t care about the media interviews, but that he felt as if he had nothing to talk about and was very unconfident, so he had to keep running away.

It is such a contradictory but true young man who becomes a super red man in another parallel world.

Attachment-Su Jian Zhi An [2022] No.129. doc

Attachment-Su Jian Zhi An [2022] No.129. doc