[Financial Afternoon Tea] Guoxin Investment announced that it will increase its holdings of the CSI Guoxin Central Enterprise Science and Technology Index Fund; US judge issues preliminary injunction

Closing comprehensive evaluation

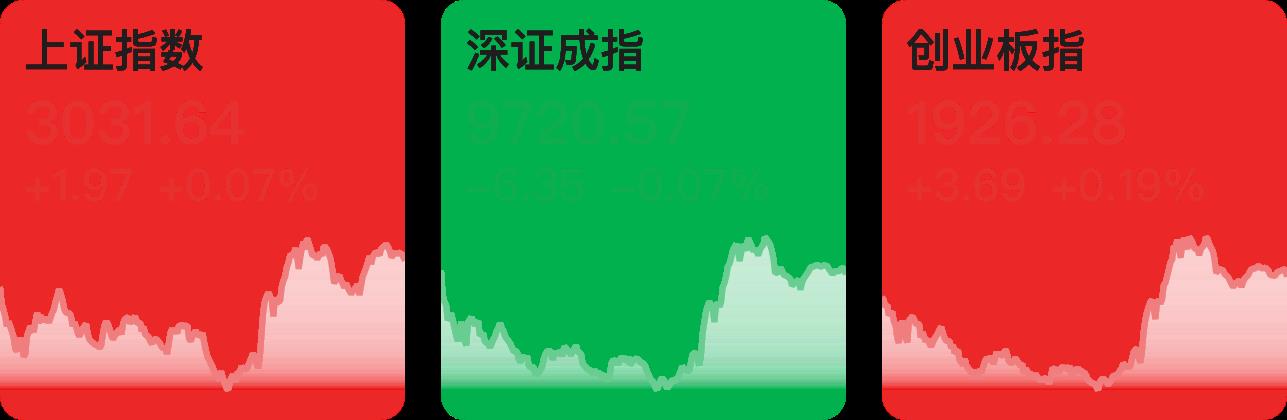

A shares:

On December 1st, the Shanghai and Shenzhen stock indexes fluctuated downward in the morning and rebounded in the afternoon, and the three major stock indexes all turned red in intraday trading. As of the close,Up by 0.07%,Down 0.07%,Up 0.19%. In terms of plates, short playsThe concept has soared.20% daily limit,、Waiting for the daily limit;Rising in the afternoon,、、Waiting for the 20% daily limit,Many stocks have risen by more than 10%; The news said that state-owned capital operating companies entered the market to buy.,The concept stocks rose in the afternoon.Daily limit; Internet, media,, software,、Waiting for the top increase; A few sectors such as automobiles and hotel catering fell.

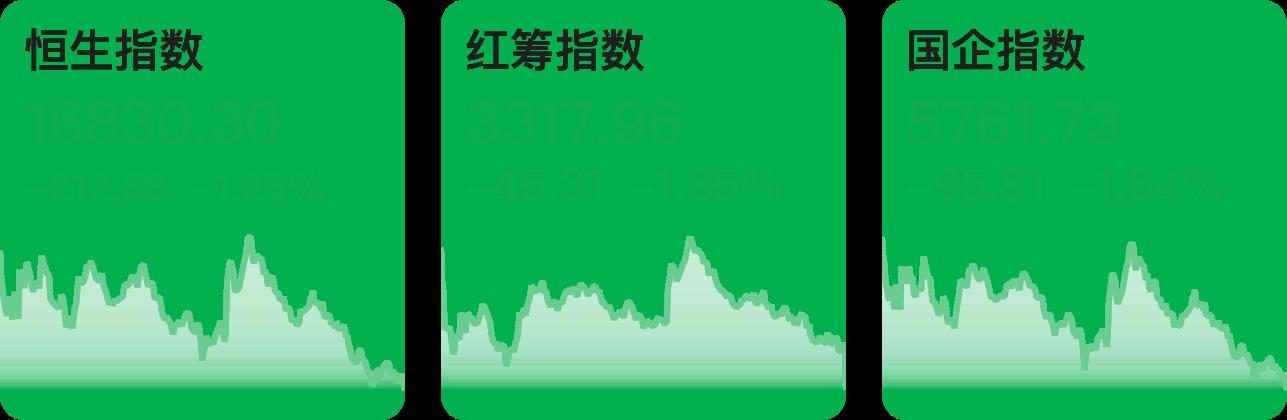

Hong kong stocks:

Hong Kong’s Hang Seng Index closed down 1.25%, and the Hang Seng Technology Index fell 1.76%.It fell by nearly 11%.Electronics fell more than 5%, Meituan,Xiaomi Group fell nearly 3%.

Asia-Pacific stock market:

The Nikkei 225 index fell by 0.17%, and the KOSPI index of South Korea fell by 1.19%.

Counting a shares:

1. The turnover of Shanghai and Shenzhen stock markets today was 834.1 billion.

2. On December 1st, as of the closing of A-shares, the total net sales of northbound funds was 4.997 billion yuan, of whichThe net sale was 4.062 billion yuan,Net sales of 935 million yuan. The turnover of northbound funds was 120.307 billion yuan, accounting for 14.42% of the total turnover of A shares, and the trading activity decreased by 7.15%.

Hot spot focusing

1. Office of the Central Financial Committee and the Central Financial Work Committee: Insist on preventing and controlling risks as the eternal theme of financial work.

The Office of the Central Financial Committee and the Central Financial Work Committee wrote "Unswervingly Take the Road of Financial Development with China Characteristics" in Qiushi. Among them, it is mentioned that risk prevention and control should be the eternal theme of financial work. To take the road of China’s characteristic financial development, we must attach great importance to the infectivity, concealment and destructiveness of financial risks, strengthen the sense of hardship, firmly establish the bottom line thinking and extreme thinking, do a good job in risk prevention and control with the sense of responsibility of "always worrying", and firmly hold the bottom line that systematic financial risks will not occur.

2. Guoxin Investment announced that it will increase its holdings of the CSI Guoxin Central Enterprise Science and Technology Index.

China Guoxin Holdings Co., Ltd. was released on December 1.It is said that its Guoxin Investment Co., Ltd. increased its holdings of the CSI Guoxin Central Enterprise Science and Technology Index Fund today and will continue to increase its holdings in the future.

3. Caixin China Manufacturing Industry in November.It rose to 50.7, the highest in three months

The manufacturing PMI of Caixin China in November 2023, which was announced on December 1st, recorded 50.7, up 1.2 percentage points from October, and returned to the expansion range, reaching a three-month high.

4. The US judge issued a preliminary injunction against the TikTok ban in Montana.

On November 30th, Judge Donald molloy of Missoula Branch of the Federal District Court for the District of Montana issued a preliminary injunction, temporarily prohibiting Montana from implementing the injunction against TikTok. According to the preliminary injunction, the ban on TikTok in Montana should be prevented from being implemented, because the claims made by TikTok and its creators as plaintiffs are reasonable, and the ban on TikTok issued by Montana may violate the freedom of speech clause of the First Amendment of the US Constitution, the federal priority setting in the US legal system and the commercial clause of the US Constitution.

5. Shanghai issued Several Opinions on Promoting the Reform, Innovation, Development and Construction of the World’s Leading Science and Technology Park in Zhangjiang High-tech Zone.

The General Office of the Shanghai Municipal People’s Government issued a notice on Several Opinions on Promoting the Reform, Innovation, Development and Construction of the World’s Leading Science and Technology Park in Zhangjiang High-tech Zone, with the goal of benchmarking the world’s leading science and technology park, and striving to form a management system and mechanism with strong overall planning, consistent powers and responsibilities, urban linkage, synergy and high efficiency in three years, so as to create a leading industry.A high-quality park with perfect, relatively concentrated space and vibrant ecology.

6. Wuhan: Support the development.Car trade-in, car going to the countryside and other automobile consumption promotion activities.

The Wuhan Municipal Government issued the Notice on Several Policies and Measures to Enhance the Development of Endogenous Motivation and Promote Economic Recovery. It is mentioned that boosting bulk consumption. Tap the potential of automobile consumption and support various enterprises and business associations to carry out various automobile consumption promotion activities such as car trade-in and car going to the countryside; Through the government’s centralized procurement of new and updated ordinary official vehicles, in principle, the proportion of car use is not less than 80%; Reward policy with sufficient points, supportThe promotion and use of automobiles. Support the promotion of green smart home appliances, encourage green home appliance production and sales enterprises to benefit the people and trade in the old ones, and promote smart home appliances, integrated home appliances, functional home appliances and other products.

Company news

1、In November, the automobile sales volume was 20,318 vehicles, up 145.92% year-on-year.

(601127) On the evening of December 1st, it was announced that the sales volume of Celestial vehicles in November was 20318, up by 145.92% year-on-year.

2、15,959 units were delivered in November, up 12.6% year-on-year.

On December 1, the delivery volume in November 2023 was announced, and a total of 15,959 new cars were delivered, a year-on-year increase of 12.6%; From January to November 2023, a total of 142,026 new cars were delivered, a year-on-year increase of 33.1%.

3、In November, a total of 20,041 new cars were delivered, a year-on-year increase of 245%.

According to official sources, a total of 20,041 new cars were delivered in November, up 245% year-on-year. The monthly delivery exceeded 20,000 units for two consecutive months, hitting a new high in a single month.

4、: Stop planning to split the holding subsidiary into the main board of Shenzhen Stock Exchange and apply for listing on the New Third Board.

(603367) announced on the evening of December 1, according to the company’s first temporary in 2023.Authorized by the general meeting, the board of directors agreed to terminate the plan to split Shandong Chenxin Fodu Pharmaceutical Co., Ltd. (referred to as "Fodu Pharmaceutical"), a holding subsidiary, into Shenzhen.The listing of the main board of the Exchange (referred to as "split listing"), and agreed that Fodu Pharmaceutical applied for listing in the National Small and Medium-sized Enterprise Share Transfer System (New Third Board) (referred to as "this listing"). After this listing, Fodu Pharmaceutical will seek to be listed on the Beijing Stock Exchange according to the future capital market environment and strategic development needs.

5. AITO series delivered 18,827 new cars in November.

The reporter learned that in November, 2023, HarmonyOS Zhixing’s AITO series delivered a total of 18,827 new cars. The new M7 delivered 15,242 new cars, with a cumulative delivery of over 27,000.

6、Since the beginning of this year, the investment in public real estate loans has exceeded 300 billion yuan.

According to "China" official micro, China actively docked a number of key real estate enterprises, and conducted in-depth business exchanges in the form of one-on-one to discuss the cooperation between banks and enterprises under the new situation, helping to build a new model of real estate development. Since this year,Corporate real estate loans have exceeded 300 billion yuan, and personal housing loans have reached nearly one trillion yuan. At the same time, we actively cooperate with the work of "guaranteeing the delivery of buildings" and increase support for new real estate areas that meet national policies. In the next step, we will actively practice the responsibility of state-owned banks, focusing on rigid and improved housing, rental housing and other fields, and three major projects, such as "village in the city, affordable housing, and emergency use".Loans, personal housing mortgage loans,Increase resources investment in loans, syndicated loans and bond underwriting and investment, and support the multi-dimensional and reasonable financing needs of housing enterprises in each cycle. At the same time, firmly adhere to the "two unwavering", for non-state-owned housing enterprises, from optimizationPolicies, speeding up the examination and approval of loans, and clarifying the duty exemption, etc., establish and improve the long-term mechanism of "dare to lend, be willing to lend, be able to lend, and be willing to lend", and continuously improve the service quality and support for non-state-owned housing enterprises.